What is Other Comprehensive Income?

Contents [show]

Comprehensive income is often listed on the financial statements to include all other revenues, expenses, gains, and losses that affected stockholder’s equity account during a period. In other words, it adds additional detail to the balance sheet’s equity section to show what events changed the stockholder’s equity beyond the traditional net income listed on the income statement.

Since the income statement only recognizes income and expenses when they are earned or incurred, many other sources of revenue and expenses are left off the statement because they haven’t been realized yet. Investors and creditors still want to know how these other items affect the equity accounts even if they are not included in the bottom line.

Keep in mind, that this does not include any owner caused changes in equity. It only refers to changes in the net assets of a company due to non-owner events and sources. For example, the sale of stock or purchase of treasury shares is not included in comprehensive income because it stems from a contribution from to the company owners. Likewise, a dividend paid to shareholders is not included in CI because it is a transaction with the shareholder. This is listed on the statement of shareholder’s equity.

Let’s take a look at what is included in this calculation.

Example

Other comprehensive income includes many adjustments that haven’t been realized yet. These are events that have occurred but haven’t been monetarily recorded in the accounting system because they haven’t been earned or incurred. You can think of it like adjusting the balance sheet accounts to their fair value.

Items recorded on the balance sheet at historical cost rarely reflect the actual value of the assets. Since the company hasn’t sold these items and earned additional revenue from them, we can’t record additional income on the balance sheet and must keep the value listed at the purchase price.

Comprehensive income changes that by adjusting specific assets to their fair market value and listing the income or loss from these transactions as accumulated other comprehensive income in the equity section of the balance sheet. Let’s take a stock investment for example. A company might invest its free cash in the stock of another company. When the stock is purchased, it is recorded on the balance sheet at the purchase price and remains at that price until the company decides to sell the stock.

What’s wrong with this treatment? Isn’t that correct? Well it is correct, but it doesn’t reflect what the stock is actually worth. The company might have paid $10 for the stock and now it’s worth $100 making the balance sheet misleading as to the true value of the company’s assets.

Here are some common examples of items other comprehensive income includes:

- Unrealized gains or losses on available-for-sale securities

- Unrealized gains or losses on other financial investments

- Unrealized gains or losses on pension and retirement benefit plans

- Foreign currency adjustments

Statement of Comprehensive Income

Whenever CI is listed on the balance sheet, the statement of comprehensive income must be included in the general purpose financial statements to give external users details about how CI is computed.

A standard CI statement is usually attached to the bottom of the income statement and includes a separate heading.

The net income is transferred down to the CI statement and adjusted for the non-owner transactions we listed above to compute the total CI for the period. This number is then transferred to the balance sheet as accumulated other comprehensive income.

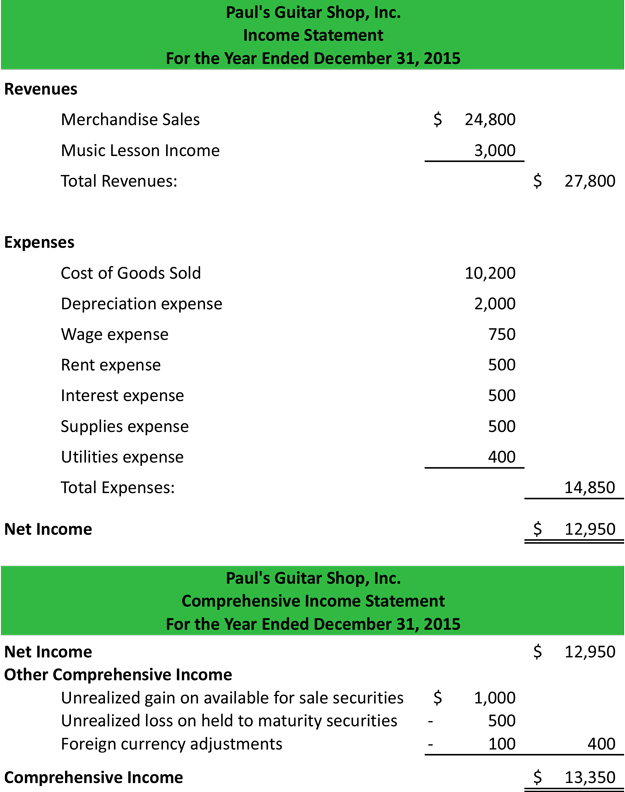

Here’s an example comprehensive statement attached to the bottom of our income statement example.

As you can see, the net income is carried down and adjusted for the events that haven’t occurred yet. This gives investors and creditors a good idea of what the company’s assets and net assets are truly worth. Keep in mind, that we are not only adjusting the assets of the company, available for sale securities, we are also adjusting the net assets of the company, stockholder’s equity.

Creditors can see how much skin investors have in the company and investors can see the potential of the company assets and future earnings and profits if these assets were actually sold and the gains were realized.

After the CI statement is prepared, we can start preparing the balance sheet.