The sales to administrative expense ratio (SAE ratio) is an efficiency ratio that measures how well a company is able to manage its non-operating expense and generate sales during the normal course of operations. In other words, this ratio measures how well the firm is utilizing its fixed cost to manage its operations smoothly, which should ultimately reflect in better sales.

Definition: What is SG&A Expense Ratio?

Contents

Administrative expenses are the expenses which are not attributable to direct production or delivery of the products or services of a company. These expenses include salaries of senior employees, accounting and finance cost, HR expenses etc. These are non-operating expenses necessary to maintain the basic operations of a company. These expenses are also called central expenses and are vital to maintain proper functioning of a company and increase efficiency of operations. In other words, these expenses are somewhat fixed and the company needs to incur regardless of the level of sales.

Sales to administrative expenses ratio measures how much sales are generated per dollar of administrative expenses incurred by the company. Higher the ratio better it is, as it implies better operating leverage of the central functions. Similarly, an increasing SAE ratio implies that the company is able to generate additional sales with the same fixed infrastructure.

Formula

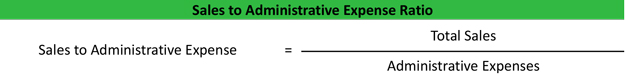

The sales to administrative expense ratio formula can be calculated by dividing total sales by administrative expenses:

Sales to Administrative Expense Ratio = Sales / Administrative Expenses

All the items in this formula can be located in the income statement of the annual report. Analyst might have to check the notes to account to get a detailed split of all ‘non-operating’ expenses of a company.

Sales are reported on the top line of the income statement of a company.

Administrative Expenses are mentioned after the Cost of goods sold and just before the operating profit in the income statement.

Companies may combine selling, general & administrative expense (SG&A) in a single line in the income statement. Analyst might decide to remove selling expenses from this value to use general & administrative expenses in calculation of the ratio.

Let’s look at a few examples.

Example

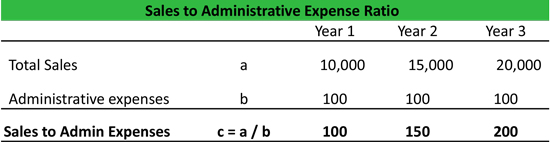

Let’s look at a hypothetical example of a company A. We have summarized the financial data along with the calculation of the ratio in the table below. In the example, we see that the company has doubled its sales in three years and has been able maintain its SG&A expenses at the same amount each year. Thus, the SAE ratio also doubled in the same period.

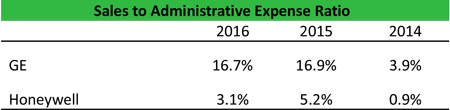

To understand the concept better let us look at two large conglomerates: GE and Honeywell. These are mega companies with wide variety of operations. Generally, they will have large central functions to support global operations. Hence, there is a focus on managing administrative expense versus the amount of sales it can generate.

GE has a sales to administrative expense ratio of less than 7.0x vs. Honeywell, which has maintained it above 7.0x during 2014 to 2016 period. Another point to note is that the ratio has been reducing for both the companies. We can explore the reason for this decline in the next section.

Analysis and Interpretation

A low SAE ratio could imply inherent inefficiencies in the corporate structure. These inefficiencies could be due to legacy issues like archaic systems and processes. For example, a company might have manual accounting processes, which require a large workforce. Analysts should consider management guidance on reducing these overheads. It might entail significant investments initially which can be leveraged over several years.

SAE ratio is also actively looked at in a merger or acquisition scenario. While looking at a prospective target, an acquirer considers the synergies that can be achieved post-merger. One way to achieve synergies is via reducing overlapping back-office function. Analyst needs to do a detailed due diligence of cost analysis to understand and comment on actual benefits of a merger.

Analysts need to look at this ratio from historical and industry point of view. If the number is reducing year on year, then it can be a source of concern, as the fixed costshave to be spread across lesser sales. Fixed costs also depend on type of industry, so a comparison across different companies can highlight some useful information. Another way to do peer analysis is to consider the size of competition. In theory, larger companies should have a higher Sales to Admin expense ratio.

In the case of GE & Honeywell, both companies have been acquiring businesses over many years. Thus, incurring several related expenses (such as advisory fees, audit fees etc.). If these acquisitions are one-off items and not expected to be repeated, an analyst should remove it from the calculation of the ratio. On the other hand, if an acquisition is a stated strategic objective of a company, it might be prudent to include these expense in the calculation. Interestingly, GE has smaller SAE ratio than Honeywell even though it’s a much larger company.

Analysts should also read the capital expenditure guidance mentioned by the management during earnings calls. A part of this expenditure might involve setting up back office and hiring senior managers. These activities might involve a large initial investment, which can result in additional sales over longer time. If these investments are value accretive, the SAE ratio should improve over time. However, if the strategy destroys value, the SAE ratio will decline.

Management typically uses the SAE ratio to forecast its corporate strategy, hiring plans, and growth planning. Many times a rapid growth phase leaves a company with disproportionately high administrative expense, complex management structure, and redundant departments. Analysts need to monitor these changes closely over many years to gauge the management success of implementation.

Practical Usage Explanation: Cautions and Limitations

Analysts need to be careful in selecting administrative expenses to be included in this ratio. The underlying idea is to look at the fixed cost of a company, so we need to be careful only to select recurring fixed costs and not the one-off items.

Sales and administrative expenses are a useful data point for merger and acquisition analysis, but you should be careful in estimating the expenses and synergies that can be achieved.

In conclusion, sales to admin expenses can provide some insightful information about the management efficacy and analysts need to use it carefully to come up with interesting discussion points with management.