Return on operating assets (ROOA) is an efficiency financial ratio that calculates the percentage return a company earns from investing money in assets used in its operating activities. In other words, this is the percentage profit that a company can expect from the purchase of a new piece of equipment.

Definition: What is Return on Operating Assets (ROOA)?

Contents [show]

Return on assets used in operations measures the ability of a company’s general business operations to produce revenue by comparing the net income produced with the current value of assets employed in operations. In other words, it shows profitability from day-to-day production resources. Some examples of operating assets include cash, accounts receivable, inventory and the fixed assets that contribute to everyday operations.

The revenue producing assets are required to carry out business functions, but the return on these assets can let company management know how much value these necessary assets add. After all, if a particular piece of expensive equipment makes little or no marginal increase in revenue, it would be wise to find a less expensive piece of equipment that can do the same job.

Comparing the return on operating assets to the return on total assets can also provide some insight on which assets are truly beneficial to own. Total assets would include long-term assets and investments outside general revenue production that may not be as liquid. By focusing solely on the operating assets, where a company has more control over costs, income can be boosted by process improvements.

Since earnings drive investor returns, shareholders are also interested in knowing the company’s return on these investments. Book value, which would include all assets, is immaterial to shareholders without earnings, so changes to this ratio are closely followed. After all, businesses are in business to make a profit, so learning how to calculate the return on operating assets equation to identify areas of improvement can lead to long-term success.

Let’s look at the formula.

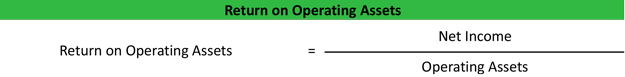

Formula

The return on operating assets formula is calculated by dividing net income by total operating assets.

Return on Operating Assets = Net Income / Operating Assets

First, locate the net income on the company’s income statement and the operating assets from the balance sheet. Be sure to only include operating assets for this calculation.

Divide the net income amount by the operating assets to reveal the percentage return on operating assets.

Now that we know how to calculate it, let’s look at an example.

Example

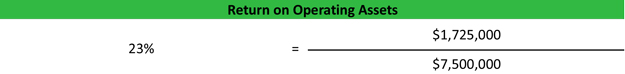

Suppose A to Z Distributors has just wrapped up its first fiscal year with a new business segment. Management wants to determine if the assets that were purchased for this new business venture were profitable. To start, the management team decides to calculate the ROOA to help narrow it down.

Net income for the A to Z Distributors was $1,725,000. Total assets on the company’s balance sheet were $10,000,000, of which $7,500,000 was classified as operating assets.

To calculate ROOA, the management team divides net income by operating assets; $1,725,000 / $7,500,000 = 23%.

Analysis and Interpretation

In the example of A to Z Distributors, a 23% return indicates that the company is earning 23 cents in profit for every dollar it invests in operating equipment. A 23% return looks like a very healthy return for an investment. However, when considering that the sole purpose of these assets is to produce income, this number would be 100% in a perfect world.

The management team should look at the calculations from previous years to note any trends or changes. An increasing return is a good thing. In this scenario, if 23% is a great improvement from previous years, then they very well may be on the right track. If the rate has declined, management would need to take a closer look to determine the cause. Management might also want to explore other options and other assets to invest its money that could potentially make more than 23 percent.

Shareholders of A to Z Distributors may also want to calculate this ratio and compare to previous years to see how well the new business venture is performing compared with other alternatives. As with other financial calculations, comparing the 23% ROOA to previous fiscal years and other companies in the industry is the key.

Practical Usage Explanation: Cautions and Limitations

Since the ROOA equation uses net income, there are several factors that could contribute to a change in this ratio. Everything from cost of goods sold to employee salaries and utilities expenses affect net income, making ROOA a fairly sensitive measurement.

Changes in ROOA over time should be evaluated, especially if the number moves lower. Management can use the ROOA tool to see which assets are most profitable and identify those that may need to be sold or otherwise taken out of service for lack of value add. One creative way to find this would be to match specific operating assets with specific revenue and expenses.

Management may also choose to move out of an industry and into another based on the equipment required to produce a certain product. For instance, if the equipment is too expensive with little returns, it might be a good idea to sell the equipment and move into a new market.

Subsequently, shareholders can also use this tool to identify good and bad investment decisions by the management and voice concerns if the number slides over time. Investors should also compare ROOA numbers with competitor companies in the same industry. Like many financial calculations, standard or average ratios like this can vary between industries, so having others to compare to is key to determining if the value is good or bad.