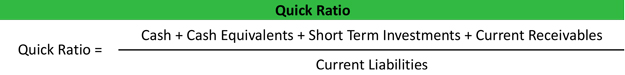

The quick ratio or acid test ratio is a liquidity ratio that measures the ability of a company to pay its current liabilities when they come due with only quick assets. Quick assets are current assets that can be converted to cash within 90 days or in the short-term. Cash, cash equivalents, short-term investments or marketable securities, and current accounts receivable are considered quick assets.

Short-term investments or marketable securities include trading securities and available for sale securities that can easily be converted into cash within the next 90 days. Marketable securities are traded on an open market with a known price and readily available buyers. Any stock on the New York Stock Exchange would be considered a marketable security because they can easily be sold to any investor when the market is open.

The quick ratio is often called the acid test ratio in reference to the historical use of acid to test metals for gold by the early miners. If the metal passed the acid test, it was pure gold. If metal failed the acid test by corroding from the acid, it was a base metal and of no value.

The acid test of finance shows how well a company can quickly convert its assets into cash in order to pay off its current liabilities. It also shows the level of quick assets to current liabilities.

Formula

Contents [show]

The quick ratio is calculated by adding cash, cash equivalents, short-term investments, and current receivables together then dividing them by current liabilities.

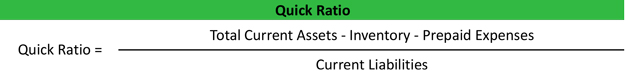

Sometimes company financial statements don’t give a breakdown of quick assets on the balance sheet. In this case, you can still calculate the quick ratio even if some of the quick asset totals are unknown. Simply subtract inventory and any current prepaid assets from the current asset total for the numerator. Here is an example.

Analysis

The acid test ratio measures the liquidity of a company by showing its ability to pay off its current liabilities with quick assets. If a firm has enough quick assets to cover its total current liabilities, the firm will be able to pay off its obligations without having to sell off any long-term or capital assets.

Since most businesses use their long-term assets to generate revenues, selling off these capital assets will not only hurt the company it will also show investors that current operations aren’t making enough profits to pay off current liabilities.

Higher quick ratios are more favorable for companies because it shows there are more quick assets than current liabilities. A company with a quick ratio of 1 indicates that quick assets equal current assets. This also shows that the company could pay off its current liabilities without selling any long-term assets. An acid ratio of 2 shows that the company has twice as many quick assets than current liabilities.

Obviously, as the ratio increases so does the liquidity of the company. More assets will be easily converted into cash if need be. This is a good sign for investors, but an even better sign to creditors because creditors want to know they will be paid back on time.

Example

Let’s assume Carole’s Clothing Store is applying for a loan to remodel the storefront. The bank asks Carole for a detailed balance sheet, so it can compute the quick ratio. Carole’s balance sheet included the following accounts:

- Cash: $10,000

- Accounts Receivable: $5,000

- Inventory: $5,000

- Stock Investments: $1,000

- Prepaid taxes: $500

- Current Liabilities: $15,000

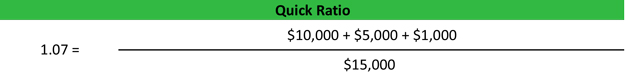

The bank can compute Carole’s quick ratio like this.

As you can see Carole’s quick ratio is 1.07. This means that Carole can pay off all of her current liabilities with quick assets and still have some quick assets left over.

Now let’s assume the same scenario except Carole did not provide the bank with a detailed balance sheet. Instead Carole’s balance sheet only included these accounts:

- Inventory: $5,000

- Prepaid taxes: $500

- Total Current Assets: $21,500

- Current Liabilities: $15,000

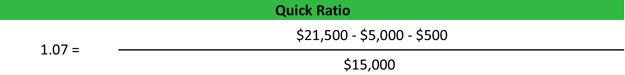

Since Carole’s balance sheet doesn’t include the breakdown of quick assets, the bank can compute her quick ratio like this: