The preferred dividend coverage ratio is a financial measure that calculates a corporation’s ability to pay the dividends owed to its preferred shareholders based on its net income. In other words, it shows investors and shareholders how well the company is doing by comparing profits to preferred dividends. If the company has sufficient profits to pay the dividends, it’s deemed to be doing well.

Definition – What is the Preferred Dividend Coverage Ratio?

Contents

This coverage ratio, also called times preferred dividend earned ratio, looks at the company’s net income to see if it is sufficient to meet the fixed dividend amount payable on its outstanding preferred shares. Thus, it is useful to all current and potential shareholders, as well as debt holders, as an important component in evaluating a company’s financial health.

Banks and other creditors will use this ratio to evaluate how much additional debt the company can handle. Even common stock shareholders should be aware of this coverage ratio, as it could have an effect on common stock dividends.

Ideally, the company will have much more profits than it needs to cover this dividend payment, but this isn’t always the case. A coverage ratio of 1 signifies the company will be able to meet its preferred dividend obligation, while a number less than 1 means it cannot and is a serious problem.

There are three important pieces of information needed to calculate the preferred dividend coverage ratio: net income, the fixed dividend rate on preferred shares and par value of the preferred shares. Each of these can be obtained from company financial statements, such as the annual report and the prospectus.

Now, let’s look at how to calculate the preferred dividend coverage ratio equation.

Formula

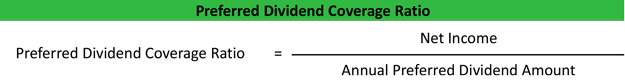

The preferred dividend coverage ratio formula is calculated by dividing the net income or total profits for the year by the preferred dividend amount for that year.

Preferred Dividend Coverage Ratio = Net Income / Annual Preferred Dividend Amount

Before we can calculate this preferred dividend coverage ratio equation, we compute the preferred dividends for the year. We can do this by multiplying the annual dividend rate by the par value of the shares. Both of these factors can be found in the preferred stock issue’s prospectus. Now, you can divide the net income, by this number to find the coverage ratio.

You may also want to look at the PDC ratio on a quarterly basis. To calculate for the quarter, divide the annual net income and the annual dividend dollar amount by four, then solve the coverage ratio equation with those figures.

Example

ABC, Inc. is an established cloud storage solution provider with a track record among investors for paying the highest preferred dividend in the sector. Larry is a money manager looking for opportunities in his high-income portfolio. He is trying to determine if adding ABC, Inc. to his portfolio is a good long-term position. One of the tools Larry uses in his search for such investments is the PDC ratio. It gives him an idea of how stable the company is and assures him if the dividend can be expected to last for his investors.

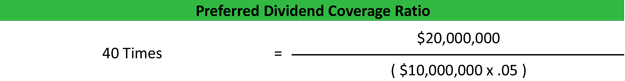

Larry pulls ABC, Inc.’s annual report to find the company’s net income was $20 million. Then, he looks at the preferred issue’s prospectus to find it was issued for a total par value of $10,000,000 at 5%.

Seeing that ABC, Inc. could cover 40 times their annual preferred dividend obligation with their annual profits, proves to Larry that there is a very good chance the dividend will be paid. It also illustrates that ABC, Inc. is in great financial shape.

Analysis and Interpretation

So, what is the preferred dividend coverage ratio used for? The number shows if the amount of income the company makes is sufficient to cover one of its most important obligations. Think of it like a homeowner’s net income supporting his mortgage payment each month. If he is spending the majority of his money to meet his mortgage obligation, any small change in his income like too many sick days off from work could mean he cannot make his mortgage payment.

The same is true for companies that have issued preferred stock. If they are barely making enough to cover their preferred dividend payments, they certainly won’t be able to afford paying common shareholders a dividend and may even run the risk of more serious issues if the situation continues.

When the preferred dividend ratio is high, it shows us that a company has ample net income to meet the obligation to preferred shareholders.

Usage Explanations and Cautions

If the preferred dividend coverage ratio is found to be low, further investigation into the company’s financial statements is needed to determine overall strength. It’s possible they just had a bad quarter. Comparing the coverage ratio over several years or quarters can give a better idea of the company’s stability.

Whether it’s a money manager looking to add to his portfolio or a bank trying to underwrite a new loan for a company, when there are preferred shares outstanding, the preferred dividend coverage ratio is an important tool in evaluating the how well a company can meet it’s obligation to its preferred shareholders.