The PEG ratio, often called Price Earnings to Growth, is an investment calculation that measures the value of a stock based on the current earnings and the potential future growth of the company. In other words, it’s a way for investors to calculate whether a stock in over or under priced by considering the earnings today and the rate of growth the company will achieve into the future.

Definition: What is the Price/Earnings To Growth Ratio?

Contents

You can think of this like an improved P/E ratio because it factors in the growth of the company by dividing the P/E by the annual growth rate. Since P/E doesn’t even look at where the company will be at in the future, a stock might look attractive. In reality, the company’s growth pattern might be stagnant. When taking this into consideration, the stock might actually be a bad buy.

Although PEG is an improved version of the P/E ratio, it doesn’t make P/E a useless comparison. Most investors use both of these calculations for different reasons. It’s important to not rely on one calculation too heavily in any investing situation. Each metrics gives a little more information about whether the investment is a good one or not. It’s important to look at all of them.

That being said, let’s take a look at how to calculate the PEG ratio.

Formula

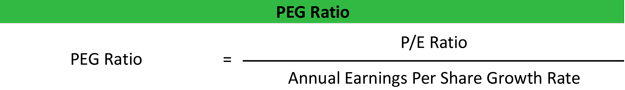

The PEG ratio formula is calculated by dividing Price Earnings by the annual earnings per share growth rate.

As you can see, this is a pretty simple equation if you understand how the numerator and the denominator are calculated. The numerator is calculated by dividing the market price per share by the earnings per share.

The denominator, on the other hand, isn’t as straight forward. Investors can use either the historical growth rate or an expected future growth rate to calculate the EPS growth. This can be somewhat problematic if the expected future growth rate is different than the historical rate because two different investors could get two completely different answers depending on what inputs they used in their equation. This difference is referred to as either trailing or forward PEG.

Analysis

What is the PEG ratio used for?

The PEG ratio is used to figure out whether a stock price is over or undervalued based on the growth patterns of the business in its industry. It’s a value calculation to see what the company is actually worth regardless of what the stock is currently trading for. Remember, stock prices are largely influenced by investor expectations, demand, and speculation. A completely worthless company could have a high stock price because investors keep pushing the price up. Look at Enron in the mid 1990s.

PEG aims to value the company based on what it produces and adjust that for the growth of the company. Since companies’ earnings and growth potential vary greatly among industries, there isn’t a standard number that indicates a good or bad investment. It varies greatly between industries, but the general rule of thumb is that any PEG less than 1 is considered a good buy because the stock price is undervalued.

Let’s take a look at an example.

Example

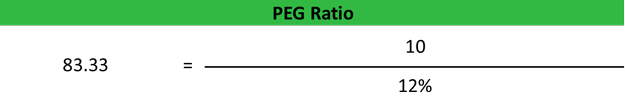

Pharm, Inc. is a pharmaceutical company that researches new medicine and technology to cure diseases. They currently have a PE of 10 and an expected annual EPS growth of 12 percent over the next five years. Here’s how they would calculate their PEG:

As you can see, Pharm, Inc. has a P-E-G of .83 indicating that the stock price is low when the expected earnings of the company are taken into account. Pharm, Inc. would be a good investment; although, it’s important for investors to Pharm’s metric with other companies’ metrics because there might be an even better deal out there.