Net operating income is a profitability formula that is often used in real estate to measure a commercial property’s profit potential and financial health by calculating the income after operating expenses are deducted. In other words, it measures the amount of cash flows that a property has after all necessary expenses have been paid.

Real estate investors and creditors use this calculation to evaluate the cash flows of a specific property and determine whether it is a good investment or creditworthy. They also use this ratio to formulate an initial value of the property. For example, they look at how much money the property can generate after all of the operating expenses have been paid in order to decide how valuable it is and what price they are willing to pay for it.

Since there are many different ways a piece of property can generate income, investors and creditors need to include all revenues in their evaluation. For example, a rental property can generate cash from renting apartments, charging parking fees, servicing vending machines, or operating laundry machining. All of these activities contribute to the cash flows of the property and necessary expenses.

This concept isn’t exclusive to real estate. Other industries refer to this calculation as EBIT or earnings before interest and taxes and use it to base investment decisions on as well.

Let’s take a look at how to calculate net operating income.

Formula

Contents [show]

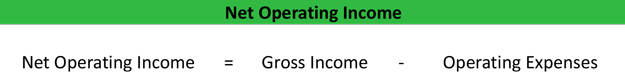

The net operating income formula is calculated by subtracting operating expenses from total revenues of a property.

As I mentioned earlier, revenues include more than just rental income. This includes all revenues from a piece of real estate. Here are the most common examples of revenue sources:

- Rental income

- Parking fees

- Service charges

- Vending machines

- Laundry machines

The operating expenses in the NOI formula consist of all necessary expenses associated with the revenue generating activities. In other words, these are all the expenses required to maintain the property and run the rental business. Here are a few examples:

- Property management fees

- Insurance

- Utilities

- Property taxes

- Repairs and maintenance

Keep in mind that there are several different expenses that are not included in this category like income taxes and interest expense.

As you can see, the net operating income equation is pretty simple, so let’s take a look at a real estate example.

Example

Marcia owns a real estate business that purchases existing rental properties and potential rental properties. She is constantly looking for new real estate to invest in that she can either improve or run more efficiently than the current owners. Today she is evaluating two small apartment buildings that show the following items on their annual income statement.

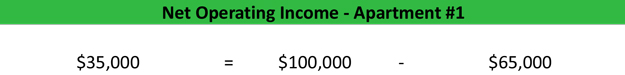

- Apartment #1

- Rental income: $100,000

- Property management fees: $20,000

- Property taxes: $15,000

- Repairs: $20,000

- Insurance: $10,000

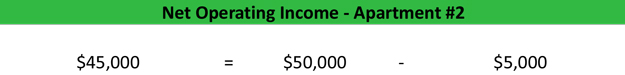

- Apartment #2

- Rental income: $50,000

- Property management fees: $1,000

- Property taxes: $1,000

- Repairs: $1,000

- Insurance: $2,000

Marcia uses the NOI equation to evaluate if either or these buildings is worth purchasing and judge which apartment complex is a better investment. Here’s how she would calculate it.

As you can see, the first apartment generates more gross revenues during the year, but it also has more expenses than the second building. Thus, the second building actually has a higher NOI than the first option. You might assume it’s a better investment than the first, but there are other things we need to consider.

Analysis

There’s a lot more that goes into evaluating whether a rental property is worth investing in than this calculation, but this equation gives us good insight into the cash flows of the properties. We need to take a look at each of the expenses to see how future cash flows will be affected.

For example, assume the first apartment just had a new roof put on and the $20,000 of repairs will not be there in future years. Now the first option is much more attractive. This is an example of how this analysis can be manipulated by management. Expenses can be frontloaded or put off to a later date to make the property look less or more attractive to different investors.

That’s why real estate investors always look at the overall condition of the property and revenue potential before running this analysis.