What is the Inventory Turnover Ratio?

Contents [show]

The inventory turnover ratio is an efficiency ratio that shows how effectively inventory is managed by comparing cost of goods sold with average inventory for a period. This measures how many times average inventory is “turned” or sold during a period. In other words, it measures how many times a company sold its total average inventory dollar amount during the year. A company with $1,000 of average inventory and sales of $10,000 effectively sold its 10 times over.

This ratio is important because total turnover depends on two main components of performance. The first component is stock purchasing. If larger amounts of inventory are purchased during the year, the company will have to sell greater amounts of inventory to improve its turnover. If the company can’t sell these greater amounts of inventory, it will incur storage costs and other holding costs.

The second component is sales. Sales have to match inventory purchases otherwise the inventory will not turn effectively. That’s why the purchasing and sales departments must be in tune with each other.

Formula

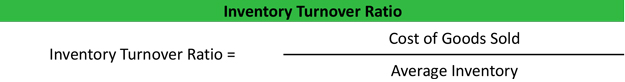

The inventory turnover ratio formula is calculated by dividing the cost of goods sold for a period by the average inventory for that period.

Average inventory is used instead of ending inventory because many companies’ merchandise fluctuates greatly throughout the year. For instance, a company might purchase a large quantity of merchandise January 1 and sell that for the rest of the year.

By December almost the entire inventory is sold and the ending balance does not accurately reflect the company’s actual inventory during the year. Average inventory is usually calculated by adding the beginning and ending inventory and dividing by two.

The cost of goods sold is reported on the income statement.

Analysis

Inventory turnover is a measure of how efficiently a company can control its merchandise, so it is important to have a high turn. This shows the company does not overspend by buying too much inventory and wastes resources by storing non-salable inventory. It also shows that the company can effectively sell the inventory it buys.

This measurement also shows investors how liquid a company’s inventory is. Think about it. Inventory is one of the biggest assets a retailer reports on its balance sheet. If this inventory can’t be sold, it is worthless to the company. This measurement shows how easily a company can turn its inventory into cash.

Creditors are particularly interested in this because inventory is often put up as collateral for loans. Banks want to know that this inventory will be easy to sell.

Inventory turns vary with industry. For instance, the apparel industry will have higher turns than the exotic car industry.

Example

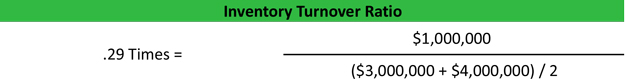

Donny’s Furniture Company sells industrial furniture for office buildings. During the current year, Donny reported cost of goods sold on its income statement of $1,000,000. Donny’s beginning inventory was $3,000,000 and its ending inventory was $4,000,000. Donny’s turnover is calculated like this:

As you can see, Donny’s turnover is .29. This means that Donny only sold roughly a third of its inventory during the year. It also implies that it would take Donny approximately 3 years to sell his entire inventory or complete one turn. In other words, Danny does not have very good inventory control.