The interest coverage ratio is a financial ratio that measures a company’s ability to make interest payments on its debt in a timely manner. Unlike the debt service coverage ratio, this liquidity ratio really has nothing to do with being able to make principle payments on the debt itself. Instead, it calculates the firm’s ability to afford the interest on the debt.

Creditors and investors use this computation to understand the profitability and risk of a company. For instance, an investor is mainly concerned about seeing his investment in the company increase in value. A large part of this appreciation is based on profits and operational efficiencies. Thus, investors want to see that their company can pay its bills on time without having to sacrifice its operations and profits.

A creditor, on the other hand, uses the interest coverage ratio to identify whether a company is able to support additional debt. If a company can’t afford to pay the interest on its debt, it certainly won’t be able to afford to pay the principle payments. Thus, creditors use this formula to calculate the risk involved in lending.

Formula

Contents [show]

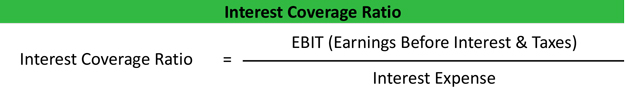

The interest coverage ratio formula is calculated by dividing the EBIT, or earnings before interest and taxes, by the interest expense. Here is what the interest coverage equation looks like.

As you can see, the equation uses EBIT instead of net income. Earnings before interest and taxes is essentially net income with the interest and tax expenses added back in. The reason we use EBIT instead of net income in the calculation is because we want a true representation of how much the company can afford to pay in interest. If we used net income, the calculation would be screwed because interest expense would be counted twice and tax expense would change based on the interest being deducted. To avoid this problem, we just use the earnings or revenues before interest and taxes are paid.

You might also want to note that this formula can be used to measure any interest period. For example, monthly or partial year numbers can be calculated by dividing the EBIT and interest expense by the number of months you want to compute.

Example

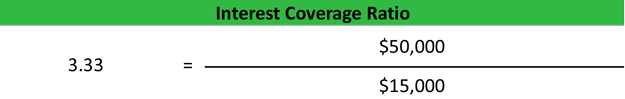

Let’s take a look at an interest coverage ratio example. Sarah’s Jam Company is a jelly and jam jarring business that cans preservatives and ships them across the country. Sarah wants to expand her operations, but she doesn’t have the funds to purchase the canning machines she needs. Thus, she goes to several banks with her financial statements to try to get the funding she wants. Sarah’s earnings before interest and taxes is $50,000 and her interest and taxes are $15,000 and $5,000 respectively. The bank would compute Sarah’s interest coverage ratio like this:

As you can see, Sarah has a ratio of 3.33. This means that has makes 3.33 times more earnings than her current interest payments. She can well afford to pay the interest on her current debt along with its principle payments. This is a good sign because it shows her company risk is low and her operations are producing enough cash to pay her bills.

Analysis

Analyzing a coverage ratio can be tricky because it depends largely on how much risky the creditor or investor is willing to take. Depending on the desired risk limits, a bank might be more comfortable with a number than another. The basics of this measurement don’t change, however.

If the computation is less than 1, it means the company isn’t making enough money to pay its interest payments. Forget paying back the principle payments on the debt. A company with a calculation less than 1 can’t even pay the interest on its debt. This type of company is beyond risky and probably would never get bank financing.

If the coverage equation equals 1, it means the company makes just enough money to pay its interest. This situation isn’t much better than the last one because the company still can’t afford to make the principle payments. It can only cover the interest on the current debt when it comes due.

If the coverage measurement is above 1, it means that the company is making more than enough money to pay its interest obligations with some extra earnings left over to make the principle payments. Most creditors look for coverage to be at least 1.5 before they will make any loans. In other words, banks want to be sure a company make at least 1.5 times the amount of their current interest payments.

Going back to our example above, Sarah’s percentage is 3.33. She is making enough money from her current operations to pay her current interest rates 3.33 times over. Her company is extremely liquid and shouldn’t have problem getting a loan to expand.