Gross margin ratio is a profitability ratio that compares the gross margin of a business to the net sales. This ratio measures how profitable a company sells its inventory or merchandise. In other words, the gross profit ratio is essentially the percentage markup on merchandise from its cost. This is the pure profit from the sale of inventory that can go to paying operating expenses.

Gross margin ratio is often confused with the profit margin ratio, but the two ratios are completely different. Gross margin ratio only considers the cost of goods sold in its calculation because it measures the profitability of selling inventory. Profit margin ratio on the other hand considers other expenses.

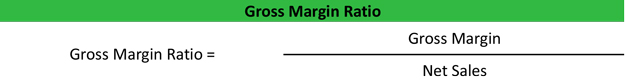

Formula

Contents [show]

Gross margin ratio is calculated by dividing gross margin by net sales.

The gross margin of a business is calculated by subtracting cost of goods sold from net sales. Net sales equals gross sales minus any returns or refunds. The broken down formula looks like this:

Analysis

Gross margin ratio is a profitability ratio that measures how profitable a company can sell its inventory. It only makes sense that higher ratios are more favorable. Higher ratios mean the company is selling their inventory at a higher profit percentage.

High ratios can typically be achieved by two ways. One way is to buy inventory very cheap. If retailers can get a big purchase discount when they buy their inventory from the manufacturer or wholesaler, their gross margin will be higher because their costs are down.

The second way retailers can achieve a high ratio is by marking their goods up higher. This obviously has to be done competitively otherwise goods will be too expensive and customers will shop elsewhere.

A company with a high gross margin ratios mean that the company will have more money to pay operating expenses like salaries, utilities, and rent. Since this ratio measures the profits from selling inventory, it also measures the percentage of sales that can be used to help fund other parts of the business. Here is another great explanation.

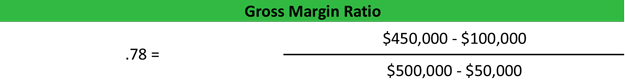

Example

Assume Jack’s Clothing Store spent $100,000 on inventory for the year. Jack was able to sell this inventory for $500,000. Unfortunately, $50,000 of the sales were returned by customers and refunded. Jack would calculate his gross margin ratio like this.

As you can see, Jack has a ratio of 78 percent. This is a high ratio in the apparel industry. This means that after Jack pays off his inventory costs, he still has 78 percent of his sales revenue to cover his operating costs.