The fixed charge coverage ratio is a financial ratio that measures a firm’s ability to pay all of its fixed charges or expenses with its income before interest and income taxes. The fixed charge coverage ratio is basically an expanded version of the times interest earned ratio or the times interest coverage ratio.

The fixed charge coverage ratio is very adaptable for use with almost any fixed cost since fixed costs like lease payments, insurance payments, and preferred dividend payments can be built into the calculation.

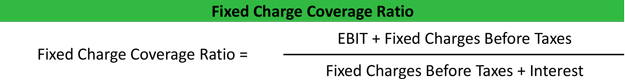

Formula

Contents [show]

The fixed charge coverage ratio starts with the times earned interest ratio and adds in applicable fixed costs. We will use lease payments for this example, but any fixed cost can be added in. This ratio would be calculated like this:

Note that any number of fixed costs can be used in this formula. This coverage ratio is not limited to only one cost.

Analysis

The fixed charge coverage ratio shows investors and creditors a firm’s ability to make its fixed payments. Like the times interest ratio, this ratio is stated in numbers rather than percentages.

The ratio measures how many times a firm can pay its fixed costs with its income before interest and taxes. In other words, it shows how many times greater the firm’s income is compared with its fixed costs.

In a way, this ratio can be viewed as a solvency ratio because it shows how easily a company can pay its bills when they become due. Obviously, if a company can’t pay its lease or rent payments, it will not be in business for much longer.

Higher fixed cost ratios indicate a healthier and less risky business to invest in or loan to. Lower ratios show creditors and investors that the company can barely meet its monthly bills.

Example

Quinn’s Harp Shop is an instrument retailer that specializes in selling and repairing harps. Quinn has been interest in remodeling the inside of his store but needs a loan in order to afford it. After giving his financial statements to the bank, the loan officer calculates Quinn’s fixed charge coverage ratio.

According to Quinn’s income statement, he has $300,000 of income before interest and taxes and interest expense of $30,000. Quinn’s current lease payment is $2,000 a month or $24,000 a year. Here is how Quinn’s ratio is calculated:

As you can see, Quinn’s ratio is six. That means that Quinn’s income is 6 times greater than his interest and lease payments. This is a healthy ratio and he should be able to receive his loan from the bank.