The Dupont analysis also called the Dupont model is a financial ratio based on the return on equity ratio that is used to analyze a company’s ability to increase its return on equity. In other words, this model breaks down the return on equity ratio to explain how companies can increase their return for investors.

The Dupont analysis looks at three main components of the ROE ratio.

Based on these three performances measures the model concludes that a company can raise its ROE by maintaining a high profit margin, increasing asset turnover, or leveraging assets more effectively.

The Dupont Corporation developed this analysis in the 1920s. The name has stuck with it ever since.

Formula

The Dupont Model equates ROE to profit margin, asset turnover, and financial leverage. The basic formula looks like this.

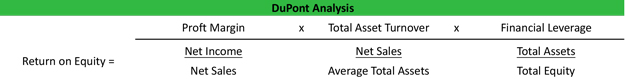

Since each one of these factors is a calculation in and of itself, a more explanatory formula for this analysis looks like this.

Every one of these accounts can easily be found on the financial statements. Net income and sales appear on the income statement, while total assets and total equity appear on the balance sheet.

Analysis

This model was developed to analyze ROE and the effects different business performance measures have on this ratio. So investors are not looking for large or small output numbers from this model. Instead, they are looking to analyze what is causing the current ROE. For instance, if investors are unsatisfied with a low ROE, the management can use this formula to pinpoint the problem area whether it is a lower profit margin, asset turnover, or poor financial leveraging.

Once the problem area is found, management can attempt to correct it or address it with shareholders. Some normal operations lower ROE naturally and are not a reason for investors to be alarmed. For instance, accelerated depreciation artificially lowers ROE in the beginning periods. This paper entry can be pointed out with the Dupont analysis and shouldn’t sway an investor’s opinion of the company.

Example

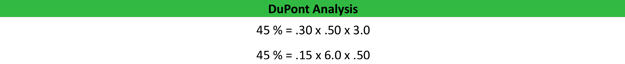

Let’s take a look at Sally’s Retailers and Joe’s Retailers. Both of these companies operate in the same apparel industry and have the same return on equity ratio of 45 percent. This model can be used to show the strengths and weaknesses of each company. Each company has the following ratios:

| Ratio | Sally | Joe |

| Profit Margin | 30% | 15% |

| Total Asset Turnover | .50 | 6.0 |

| Financial Leverage | 3.0 | .50 |

As you can see, both companies have the same overall ROE, but the companies’ operations are completely different.

Sally’s is generating sales while maintaining a lower cost of goods as evidenced by its higher profit margin. Sally’s is having a difficult time turning over large amounts of sales.

Joe’s business, on the other hand, is selling products at a smaller margin, but it is turning over a lot of products. You can see this from its low profit margin and extremely high asset turnover.

This model helps investors compare similar companies like these with similar ratios. Investors can then apply perceived risks with each company’s business model.