The days sales outstanding calculation, also called the average collection period or days’ sales in receivables, measures the number of days it takes a company to collect cash from its credit sales. This calculation shows the liquidity and efficiency of a company’s collections department.

In other words, it shows how well a company can collect cash from its customers. The sooner cash can be collected, the sooner this cash can be used for other operations. Both liquidity and cash flows increase with a lower days sales outstanding measurement.

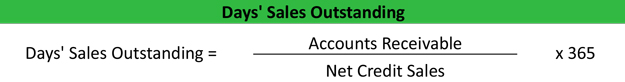

Formula

The ratio is calculated by dividing the ending accounts receivable by the total credit sales for the period and multiplying it by the number of days in the period. Most often this ratio is calculated at year-end and multiplied by 365 days.

Accounts receivable can be found on the year-end balance sheet. Credit sales, however, are rarely reported separate from gross sales on the income statement. The credit sales figure will most often have to be provided by the company.

This formula can also be calculated by using the accounts receivable turnover ratio.

Analysis

The days sales outstanding formula shows investors and creditors how well companies’ can collect cash from their customers. Obviously, sales don’t matter if cash is never collected. This ratio measures the number of days it takes a company to convert its sales into cash.

A lower ratio is more favorable because it means companies collect cash earlier from customers and can use this cash for other operations. It also shows that the accounts receivables are good and won’t be written off as bad debts.

A higher ratio indicates a company with poor collection procedures and customers who are unable or unwilling to pay for their purchases. Companies with high days sales ratios are unable to convert sales into cash as quickly as firms with lower ratios.

Example

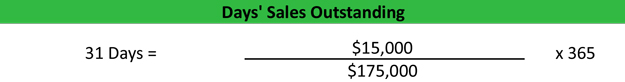

Devin’s Long Boards is a retailer that offers credit to customers. Devin often selling inventory to customers on account with the agreement that these customers will pay for the merchandise within 30 days. Some customers promptly pay for their goods, while others are delinquent. Devin’s year-end financial statements list the following accounts:

- Accounts Receivable: $15,000

- Net Credit Sales: $175,000

Devin’s days sales is calculated like this:

As you can see, it takes Devin approximately 31 days to collect cash from his customers on average. This is a good ratio since Devin is aiming for a 30 day collection period.