The cash ratio or cash coverage ratio is a liquidity ratio that measures a firm’s ability to pay off its current liabilities with only cash and cash equivalents. The cash ratio is much more restrictive than the current ratio or quick ratio because no other current assets can be used to pay off current debt–only cash.

This is why many creditors look at the cash ratio. They want to see if a company maintains adequate cash balances to pay off all of their current debts as they come due. Creditors also like the fact that inventory and accounts receivable are left out of the equation because both of these accounts are not guaranteed to be available for debt servicing. Inventory could take months or years to sell and receivables could take weeks to collect. Cash is guaranteed to be available for creditors.

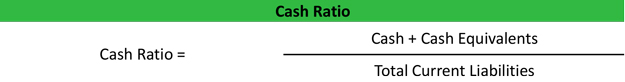

Formula

Contents [show]

The cash coverage ratio is calculated by adding cash and cash equivalents and dividing by the total current liabilities of a company.

Most companies list cash and cash equivalents together on their balance sheet, but some companies list them separately. Cash equivalents are investments and other assets that can be converted into cash within 90 days. These assets are so close to cash that GAAP considers them an equivalent.

Current liabilities are always shown separately from long-term liabilities on the face of the balance sheet.

Analysis

The cash ratio shows how well a company can pay off its current liabilities with only cash and cash equivalents. This ratio shows cash and equivalents as a percentage of current liabilities.

A ratio of 1 means that the company has the same amount of cash and equivalents as it has current debt. In other words, in order to pay off its current debt, the company would have to use all of its cash and equivalents. A ratio above 1 means that all the current liabilities can be paid with cash and equivalents. A ratio below 1 means that the company needs more than just its cash reserves to pay off its current debt.

As with most liquidity ratios, a higher cash coverage ratio means that the company is more liquid and can more easily fund its debt. Creditors are particularly interested in this ratio because they want to make sure their loans will be repaid. Any ratio above 1 is considered to be a good liquidity measure.

Example

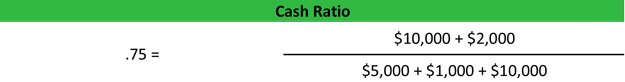

Sophie’s Palace is a restaurant that is looking to remodel its dining room. Sophie is asking her bank for a loan of $100,000. Sophie’s balance sheet lists these items:

- Cash: $10,000

- Cash Equivalents: $2,000

- Accounts Payable: $5,000

- Current Taxes Payable: $1,000

- Current Long-term Liabilities: $10,000

Sophie’s cash ratio is calculated like this:

As you can see, Sophie’s ratio is .75. This means that Sophie only has enough cash and equivalents to pay off 75 percent of her current liabilities. This is a fairly high ratio which means Sophie maintains a relatively high cash balance during the year.

Obviously, Sophie’s bank would look at other ratios before accepting her loan application, but based on this coverage ratio, Sophie would most likely be accepted.