The cash flow coverage ratio is a liquidity ratio that measures a company’s ability to pay off its obligations with its operating cash flows. In other words, this calculation shows how easily a firm’s cash flow from operations can pay off its debt or current expenses.

The cash flow coverage ratio shows the amount of money a company has available to meet current obligations. It is reflected as a multiple, illustrating how many times over earnings can cover current obligations like rent, interest on short term notes and preferred dividends. Essentially, it shows current liquidity.

Definition: What is the Cash Flow Coverage Ratio?

Contents

This measurement gives investors, creditors and other stakeholders a broad overview of the company’s operating efficiency. Companies with huge cash flow ratios are often called cash cows, with seemingly endless amounts of cash to do whatever they like.

For individuals, a high cash flow ratio is like having a nice buffer in a checking account to save after all monthly living expenses have been covered. In business, an adequate cash flow coverage ratio equates to a safety net if business cycles slow.

Banks look closely at this ratio to determine repayment risk when issuing a loan to a business. This is similar to consumer lending practices where the lender wants the borrower to remain under a certain debt-to-income threshold.

Let’s see how to calculate the cash flow ratio for a business.

Formula

There are a few different ways to calculate the cash flow coverage ratio formula, depending on which cash flow amounts are to be included. A general measure of the company’s ability to pay its debts uses operating cash flows and can be calculated as follows:

Cash Flow Coverage Ratio = Operating Cash Flows / Total Debt

Another way to figure cash flow coverage ratio is to add in depreciation and amortization to earnings before interest and taxes (EBIT) first:

Cash Flow Coverage Ratio = (EBIT + depreciation + amortization) / Total Debt

Now, let’s see an example of this calculation at work.

Example

Suppose XYZ & Co. is seeking out a loan to build a new manufacturing plant. The lender needs to review the company’s financial statements to determine XYZ & Co.’s credit worthiness and ability to repay the loan. Properly evaluating this risk will help the bank determine appropriate loan terms for the project.

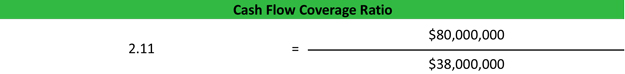

One such measurement the bank’s credit analysts look at is the company’s coverage ratio. To calculate, they review the statement of cash flows and find last year’s operating cash flows totalled $80,000,000 and total debt payable for the year was $38,000,000.

Cash flow coverage ratio = $80,000,000 / $38,000,000 = 2.105

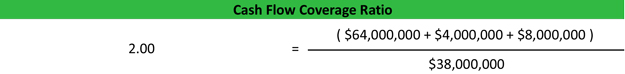

Additionally, a more conservative approach is used to verify, so the credit analysts calculate again using EBIT, along with depreciation and amortization. The statement of cash flows showed EBIT of $64,000,000; depreciation of $4,000,000 and amortization of $8,000,000.

Cash flow coverage ratio = ($64,000,000 + $4,000,000 + $8,000,000) / $38,000,000 = 2

The credit analysts see the company is able to generate twice as much cash flow than what is needed to cover its existing obligations. Depending on its lending guidelines, this may or may not meet the bank’s loan requirements.

Analysis and Interpretation

The cash flow coverage ratio does a good job of illustrating that, if a temporary slow-down in earnings hit the company, current obligations would still be met and the business could make it through such bumps in the road, though only for a short time. As with other financial calculations, some industries operate with higher or lower amounts of debt, which affects this ratio.

In the scenario above, the bank would want to run the calculation again with the presumed new loan amount to see how the company’s cash flows could handle the added load. Too much of a decrease in the coverage ratio with the new debt would signal a greater risk for late payments or even default.

Practical Usage Explanation: Cautions and Limitations

Lending is not the only time cash flow coverage becomes important. Investors also want to know how much cash a company has left after paying debts. After all, common shareholders are last in line in liquidation, so they tend to get antsy when most of the company’s cash is going to pay debtors instead of raising the value of the company.

Shareholders can also gauge the possibility of cash dividend payments using the cash flow coverage ratio. If a company is operating with a high coverage ratio, it may decide to distribute some of the extra cash to shareholders in a dividend payment.

Using this in conjunction with other financial calculations, such as return on retained earnings, investors can get a better sense of how well the company is using the earnings it generates. Ultimately, if the cash flow coverage ratio is high, the company is likely a good investment, whether return is seen from dividend payments or earnings growth.