The cash conversion cycle is a cash flow calculation that attempts to measure the time it takes a company to convert its investment in inventory and other resource inputs into cash. In other words, the cash conversion cycle calculation measures how long cash is tied up in inventory before the inventory is sold and cash is collected from customers.

The cash cycle has three distinct parts. The first part of the cycle represents the current inventory level and how long it will take the company to sell this inventory. This stage is calculated by using the days inventory outstanding calculation.

The second stage of the cash cycle represents the current sales and the amount of time it takes to collect the cash from these sales. This is calculated by using the days sales outstanding calculation.

The third stage represents the current outstanding payables. In other words, this represents how much a company owes its current vendors for inventory and goods purchases and when the company will have to pay off its vendors. This is calculated by using the days payables outstanding calculation.

Formula

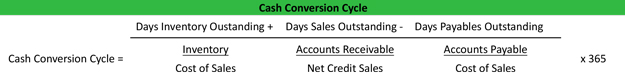

The cash conversion cycle is calculated by adding the days inventory outstanding to the days sales outstanding and subtracting the days payable outstanding.

All three of these smaller calculations will have to be made before the CCC can be calculated.

Analysis

The cash conversion cycle measures how many days it takes a company to receive cash from a customer from its initial cash outlay for inventory. For example, a typical retailer buys inventory on credit from its vendors. When the inventory is purchased, a payable is established, but cash isn’t actually paid for some time.

The payable is paid within 30 days and the inventory is marketed to customers and eventually sold to a customer on account. The customer then pays for the inventory within 30 days of purchasing it.

The cash cycle measures the amount of days between paying the vendor for the inventory and when the retailer actually receives the cash from the customer.

As with most cash flow calculations, smaller or shorter calculations are almost always good. A small conversion cycle means that a company’s money is tied up in inventory for less time. In other words, a company with a small conversion cycle can buy inventory, sell it, and receive cash from customers in less time.

In this way, the cash conversion cycle can be viewed as a sales efficiency calculation. It shows how quickly and efficiently a company can buy, sell, and collect on its inventory.

Example

Tim’s Tackle is a retailer that sells outdoor and fishing equipment. Tim buys its inventory from one main vendor and pays its accounts within 10 days in order to get a purchase discount. Tim has a fairly high inventory turnover ratio for his industry and can collect accounts receivable from his customer within 30 days on average.

Tim’s days calculations are as follows:

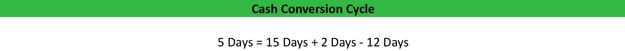

- DIO represents days inventory outstanding: 15 days

- DSO represents days sales outstanding: 2 days

- DPO represents days payable outstanding: 12 days

Tim’s conversion cycle is calculated like this:

As you can see, Tim’s cash conversion cycle is 5 days. This means it takes Tim 5 days from paying for his inventory to receive the cash from its sale. Tim would have to compare his cycle to other companies in his industry over time to see if his cycle is reasonable or needs to be improved.