The capitalization ratio, often called the Cap ratio, is a financial metric that measures a company’s solvency by calculating the total debt component of the company’s capital structure of the balance sheet. In other words, it calculates the financial leverage of the company by comparing the total debt with total equity or a section of equity. The most common capitalization ratios are:.

- Debt to equity ratio

- Long-term debt ratio

- Debt to capitalization ratio

Debt and equity are the two main components of the capital structure of a company and are the main sources to finance its operations.

Definition: What is the Capitalization Ratio?

Contents

Capitalization ratio describes to investors the extent to which a company is using debt to fund its business and expansion plans. Generally, debt is considered riskier than equity (from company’s point of view). Hence the higher the ratio, the riskier the company is. Companies with higher capitalization ratio run higher risk of insolvency or bankruptcy in case they are not able to repay the debt as per the predetermined schedule. However, higher debt on the books could also be earnings accretive if the business is growing in a profitable manner (more on this in the analysis section).

The company uses this ratio to manage its capital structure and determine the debt capacity. Investors use it to gauge the riskiness of investment and form an important component of asset valuation (higher risk implies higher expected return). Lenders use it to determine if the company is within the predetermined limits and if there is more headroom to lend more money.

Let’s take a look at how to calculate the capitalization ratio.

Formula

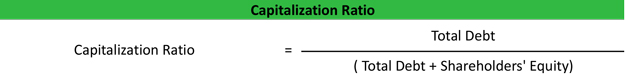

The capitalization ratio formula is calculated by dividing total debt into total debt plus shareholders’ equity. Here’s an example:

Total Debt to Capitalization = Total Debt / (Total Debt + Shareholders’ Equity)

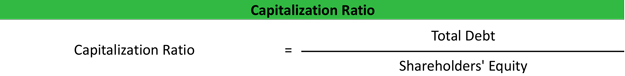

You can also calculate the capitalization ratio equation by dividing the total debt by the shareholders’ equity.

Debt-Equity ratio = Total Debt / Shareholders’ Equity

As you can see that both these formulas are very similar and can be calculated by slight modification from one another. All of the components in these equations can be found on the face of the balance sheet.

Total debt refers to both long-term and short-term debts of a company

Shareholder’s equity refers to the book value of equity investment made by the investors

The debt-to-equity investment is calculated by simply dividing the two values. For total debt to cap ratio, we simply divide total debt with the sum or equity and debt (i.e. the total capital of a company)

Now that we know how to calculate the capitalization ratio equation, let’s take a look at some examples.

Example

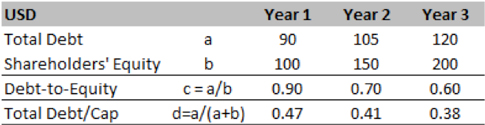

We will start with a hypothetical example of Turner Co. Their last three years of activity is summarized in the tables below. The debt-Equity ratio in year 1 was 0.9, which implies for every USD 1 of equity there was USD 0.9 of debt in the books. This reduced by the end of Year three to 0.6.

On the other hand, the Total Debt-to-cap ratio of 0.47 in year 1 implies that 47% of the capital structure of Company A is funded by Debt while the remaining 53% is via equity. This ratio reduces to 0.38 implying higher usage of equity in the future years.

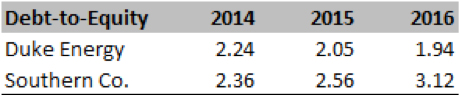

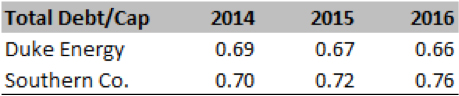

Now let’s look at a real world example of Duke Energy and Southern Co. Listed below are the ratios calculated from the SEC 10K for each company.

As we can see from the numbers, the debt to equity ratio for both the firms have been above 2.0x (2014-16) implying that majority of the firms expansion is driven by debt. This is further corroborated by the Total debt/Cap ratio which suggests 65-70% of the total capital is debt while the remaining is equity.

Let us now interpret the ratio and extract key information about the financial health of the companies.

Analysis and Interpretation

Generally, a cap ratio of less than 0.5 is considered healthy, but we need to look at the ratio in the context of the company’s past and industry averages. For industries, which own physical assets, (like utility companies) it is common to have much higher debt compared to the equity. Sometimes a particular bond or loan is linked to a particular project or asset.

In the hypothetical example of Turner Co above, we noted that both the ratios are reducing. Hence, the company might be in process of delivering its balance sheet or is finding equity to be cheaper source of funding compared to debt.

In the real world example of Duke and Southern, we can see that in the three year period, Duke has reduced its leverage while Southern has increased it. Analyzing the numbers further, we notice that Southern has been expanding significantly hence needs debt to grow business. If this strategy proves correct, it could create long-term value for investors.

As with any ratio, analysts need to spend considerable effort to decode this ratio and understand the underlying drivers. Every industry will have a typical capital structure (with company specific differences) and this will determine the cap ratio maintained by the company. Corporate actions (such as M&A) can also impact the capital structure of a company. Especially, if a company is buying distressed assets then the combined capital structure might be debt heavy. Analyst need to be aware about all these contexts before forming an opinion on the financial health of a company.

Analyst should also be aware of the optimal capital structure the company management is targeting. Cap ratio is used in asset pricing (or company valuation) as an input to the discount rates. Hence, analysts should focus on the target capital structure to understand the future risk potential. Analysts should always ascertain if this target structure is practically feasible given the industry dynamics, company operations, and macro-economic condition. Management might guide towards very aggressive targets just to appease the investor community, but it is the job of an analyst to understand the sensibility of this plan. Details about the management view can be found in the Management discussion section of a 10-K or the transcripts of the quarterly earnings calls.

Having debt on the balance sheet is not always negative. Debt could be cheaper than equity and provides some degree of tax shield in terms of interest repayment. Hence, utilized carefully, debt can have a magnifying impact on the earnings. However, too much debt restricts the management decision making as lenders normally put in place covenants which prohibit management from taking certain actions which can jeopardize the interest of the lender.

Practical Usage Explanation: Cautions and Limitations

Analysts need to be careful in using the balance sheet numbers, as they are normally reported at book value, which might be significantly different from the replacement value or the liquidation value of the asset. Analyst also use the market cap instead of book value (in case the company is listed) and current value of debt if the bonds are also traded on the market.

Analyst should consider several off- balance sheet items such as operating lease, certain pension obligations to get the full picture of long-term obligation.

Finally, this ratio should be looked at in conjunction with several other leverage ratios to get a holistic view on the financial riskiness of a company. Some of the most relevant ratios in this case could be:

- LT debt/Total Cap

- Total debt/Total assets

- Total debt/Equity

- LT debt/ Equity

In conclusion, this article introduces an important concept on the capital structure of a company, and asset valuation which is widely used in asset pricing and valuation.