The big four accounting firms, most commonly referred to as “The Big 4,” are the world’s largest and most prestigious audit, tax, and professional service companies.

As of 2022, the Big 4 Accounting Firms include:

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- Ernst & Young (E&Y)

- Klynveld Peat Marwick Goerdeler (KPMG)

Combined they perform more than 80 percent of the public company audits in the U.S. and gross more than $100 billion dollars in revenues annually. There’s no wonder why it’s a dream of so many public accountants to land a job with one of them. They basically run the accounting industry. The Big Four don’t limit their services to public companies though. They also work with large privately held companies, non-profit groups, and high wealth individuals.

These accounting firms have earned the trust and respect of our society because of their dedication to integrity. Their work is highly respected and associated with professionalism and quality. In other words, these four accounting firms symbolize the ideals of the public accounting profession and industry as a whole.

It’s no wonder why accountants strive to work for these firms right out of college. They represent the pinnacle of an accounting career, but before we get into landing a job with the big four, let’s talk about who they are.

What is a Big 4 Accounting Firm?

Contents [show]

Although we typically think of these firms as four individual companies, they are actually four large networks of member firms, usually called a professional services network, located all over the world.

Each network is owned and operated independently from one another with a membership agreement in place to share the company name, image, brand, and standards. You can think of it like a professional franchise.

Each firm has about 100 offices in the United States alone. Yup, they are that big. These hundred offices consist of large regional offices like a Chicago office and small to mid-sized offices in city outskirts and suburbs. All of the big four firms rank on the Fortune 100 best companies to work for lists every year.

Compare the Big Four Firms by the Numbers

Here’s a list of the big 4 accounting firms along with their firm size, revenue, and salary numbers to see which one you should work for.

Deloitte

Deliotte is the world’s largest big four accounting firm with more than 225,000 professionals employed in 150 countries. They have a higher market share of Fortune 500 audit clients than any of the other three firms. Deloitte also sets itself apart from the other big 4 because they are the only firm with a global headquarters is located in the United States.

In 1845 William Deloitte formed Deloitte out of his London based office. In 1880 he opened his first office in New York and became the first person appointed to audit a public company. After seeing some success in America, Deloitte merged with Haskins and Sells in 1896.

This organization remained unchanged until 1989 when the three partners merged with Touche Ross to form Deloitte and Touche. Later in 1993 the company renamed itself Deloitte Touche Tohmatsu because of yet another merger.

Throughout the 1990s D&T acquired and grew various consulting groups and agencies. In 2002, D&T merged most of the European and South American Arthur Andersen consulting business into their other foreign consulting businesses. Over the last few decades Deloitte’s presence in the industry and total revenues have grown drastically. Deloitte is almost always ranked in the top 100 best companies to work for in Fortune Magazine. They ranked 97 in 2015.

Let’s look at some company data:

- Headquarters: United States

- Number of employees: 225,400

- Number of locations: Not specified

- Number of countries: 150

- Job applicants in 2015: 319,513

- Jobs filled in 2015: 12,183

- New graduates hired in 2015: 4,938

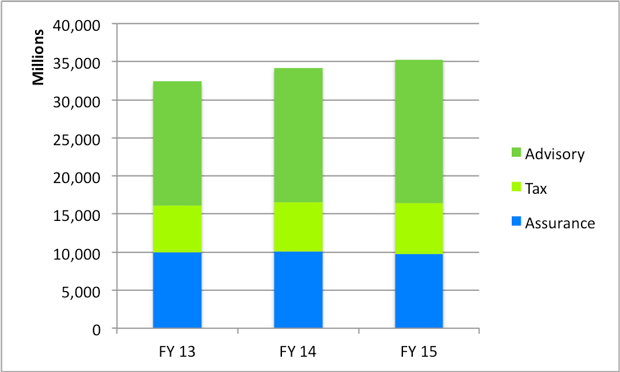

Deloitte Revenue Numbers

Revenues in Millions

- FY 15: $35,200

- FY 14: $34,200

- FY 13: $32,400

D&T’s growth of the past three years is steady and consistent. Their tax and assurance service sectors have remained about the same year of year, but their advisory and consulting business keeps growing year after year. Although PwC did beat D&T’s gross revenue number in 2015, D&T does employ more professionals and has generated more revenues two out of the last three years.

Deloitte Recruiting

Deloitte recruiters attend career fairs at most major universities and colleges around the country giving students access to their leadership programs and internship opportunities. They also participate in many conferences and competitions like the Envision Leadership Conference, AERS Advisory Case Competition, and the NextGen Leaders Program. Each of these events are great opportunities to meet recruiters and other team members. Remember, the more interaction you have with the big four CPA firms, the more likely will hire you down the road.

Deloitte University

Deloitte University was formed in 2012 as an educational branch to provide current employees and future hires training in all areas of public accounting including tax, assurance, and advisory.

D&T has also developed college accounting courses and full curriculum for college programs. Currently, there are more than 20 Deloitte accounting colleges and universities utilizing their materials. If you think you want to study accounting, become a CPA, and work in public accounting, you should definitely look into these schools. They offer the best accounting education in the country.

If you’d like more information about Deloitte, feel free to contact a local office near you directly.

New York D&T Contact Information

140 Broadway 49th Floor

New York, NY 10005

Phone: (212) 829-6000

Fax: (212) 829-6100

www.deloitte.com

PricewaterhouseCooopers

Pricewaterhouse Coopers, or PwC for short, is the world’s second largest accounting firm with over 750 offices in more than 150 countries. Its headquarters is located in the United Kingdom and dates all the way back to 1849 with its founder Samuel Price. Obviously, PwC has expanded quite a bit with a few mergers over its 150+ year existence.

The two most notable mergers happened in 1874 and 1998. In 1874 one of the original partners left the small accounting firm leaving only Price and Waterhouse to resume the business. Thus, starting in 1874 the firm was known as Price, Waterhouse & Co. Over one hundred years later PW merged with Coopers & Lybrand to create the brand we know today as PricewaterhouseCoopers. And yes, in print the “w” is always a lower case letter.

During the 1990s PwC grew rapidly and became one of the industry standards in the United States. They also acquired many of Arthur Andersen’s Chinese client base after their collapse. Today, PwC has been consistently ranked among the top 100 companies to work for by Fortune Magazine for the last 11 years. They ranked number 74 in 2015.

Let’s look at some company data:

- Headquarters: United Kingdom

- Number of employees: 208,100

- Number of locations: 756

- Number of countries: 157

- Job applicants in 2015: 305,320

- Jobs filled in 2015: 13,691

- New graduates hired in 2015: 4,529

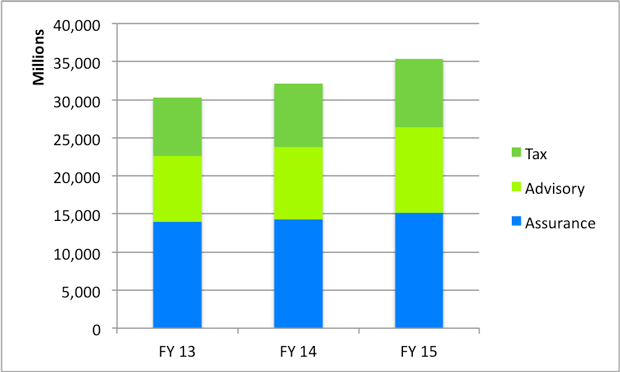

PwC Revenue Numbers

Revenues in Millions

- FY 15: $35,356

- FY 14: $32,166

- FY 13: $30,303

As you can see, PwC has maintained steady revenue growth for the past three years. They even outgrew Deloitte in fiscal year 2015. All service sectors seem to be experiencing growth over the past few years, but assurance has grown the most. This typically means there are more job opportunities in this area.

PwC Recruiting

PwC actively recruits college students across the country into their student programs. They have many different tracks like Aspire, Challenge, Explore, Start, Elevate, Advance, and Launch. Each of these programs is designed to give college students opportunities to learn, grow professionally, and gain experience in the professional world. Not to mention, students are about 1000 times more likely to be hired at PwC if they had an internship or a student program experience before.

PwC Open University

PwC Open University is PricewaterhouseCooper’s free online continuing business education platform. Anyone can sign up for their lectures and earn CPE credit hours for free. This is not only a great resource; it’s also a great learning tool for new hires and people interesting in getting a job in public accounting. You can find more information here.

If you’d like more information about PricewaterhouseCoopers, feel free to contact a local PwC office near you.

New York PwC Contact Information

101 Park Avenue 18th Floor

New York, NY 10178

Phone: (212) 697-1900

Fax: (212) 551-6732

www.pwc.com

Ernst & Young

Ernst & Young, also known as EY, is the third largest big 4 CPA firm with over 700 offices located in over 150 countries around the world. Its global headquarters is located in the UK where Harding and Pullein originally found it in 1849. Like all large accounting firms, EY went through a series of mergers over the years.

There were several mergers between firms like Whinney Smith & Whinney, Ernst & Ernst, Arthur Young & Co, and Broads Paterson & Co to form the fourth largest accounting firm in 1979. In 1989, Ernst & Whinney merged with Arthur Young to create the modern EY.

Like the big four firms, EY saw growth and expansion in the 1990s and early 2000s in their consulting and advisory businesses. This drew concerns from the SEC and other regulators at the true independence of the big 4 public accounting firms and their clients. EY took a big step in 2000 when they were the first firm to officially and formally separate their consulting side from their assurance side. Now EY is often viewed as one of the best accounting firms to work for and are typically ranked on the top 100 best companies to work for by Fortune Magazine. They ranked number 79 in 2015.

Now let’s look at some company data:

- Headquarters: United Kingdom

- Number of employees: 212,000

- Number of locations: 700

- Number of countries: 150

- Job applicants in 2015: 303,480

- Jobs filled in 2015: 11,864

- New graduates hired in 2015: 3,405

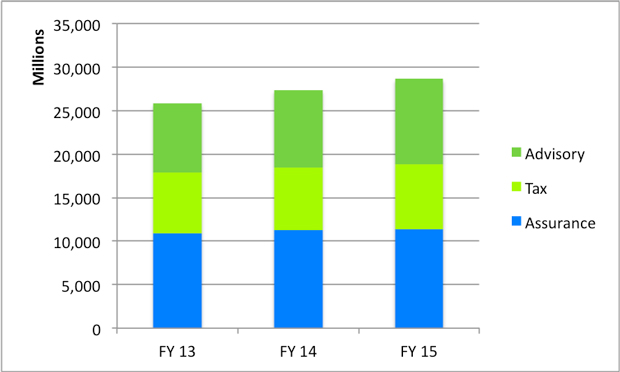

EY Revenue Numbers

Revenues in Millions

- FY 15: $28,655

- FY 14: $27,369

- FY 13: $25,829

As typical with the BIG FOUR over the past few years, EY’s total revenue has consistently climbed year over year. Although each sector has grown slightly since 2013, EY’s advisory business has increased the most. This means there will be more job opening and opportunities for new hires in the future. You might want to expand your view from just focusing on audit and tax to advisory if you are still in college. It looks like this field is going to continue to grow in the future.

EY Recruiting

EY makes a concentrated effort to find highly qualified and ambition college students to enroll in their internship programs and leadership conferences. EY focuses on hiring a larger percentage of their interns because it works. Think about it. They can train students and test them out for a trial run during the internship. After they are fully trained and graduate college, they become full time team members. It’s a great model that they take to colleges around the country.

EY Tax Accounting University

EY has developed a highly technical and advanced tax accounting and reporting program for accounting professionals. It consists of three different courses starting with the basics of tax law and ending with advanced income tax compliance. They courses are held at different EY locations around the country. Check here EY TAU for scheduling information.

If you want more information about Ernst & Young, feel free to contact your local EY office.

New York EY Contact Information

5 Times Square

New York, NY 10036-6530

Phone: (212) 773-3000

Fax: (212) 773-6350

www.ey.com

KPMG

KPMG is the fourth largest big four accounting firm employing 162,000 people. Their global headquarters is located in Amsterdam although it was not originally founded there. William Peat founded the company in London in 1891.

Through a series of mergers starting in 1925, KPMG started to take its modern form. In 1979 Klynveld Kraayenhof & Co. of the Netherlands, McLintock Main Lafrentz of the United Kingdom and United States, and Deutsche Treuhandgesellschaft of Germany merged to form KMG. Later in 1987 Peat Marwick merged with KMG to form the modern KPMG.

In 1997 KPMG attempted to merge with PwC, but it was stalled in the court system and eventually dropped. After the failed merger KPMG went on to divest much of its consulting and legal businesses. Now it focuses on three main services: audit, advisory, and tax. KPMG has seen repeated growth year over here and is viewed as one of the top accounting firms to work for. In fact, Fortune Magazine rated KPMG highest out of all four big accounting firms in 2015. They were ranked number 63.

Now let’s look at some company data:

- Headquarters: Netherlands

- Number of employees: 162,000

- Number of locations: 700

- Number of countries: 150

- Job applicants in 2015: 325,192

- Jobs filled in 2015: 5,662

- New graduates hired in 2015: 2,127

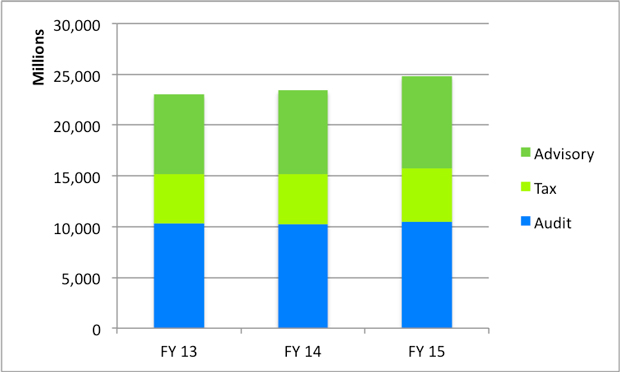

KPMG Revenue Numbers

Revenues in Millions

- FY 15: $24,820

- FY 14: $23,420

- FY 13: $23,030

Although revenues have increased over the past three years, KPMG’s growth is the slowest out of the big four accounting firms. Tax and audit service revenue stayed about the same for the past three years with advisory fees increasing slightly. Total revenues are up, but not as much as the big CPA firms.

KPMG Recruiting

KPMG’s recruiting process starts with colleges. They focus on getting to know students early in their college careers with programs designed for each class year. They focus on helping students gain access to their leadership training series, internships, and competitions. You can go to the student section on their site for more information about finding a KPMG recruiting rep for your university.

KPMG University Connection

The KPMG University Connection is an audit, tax, and general business curriculum created by KPMG to help students learn more about public accounting. The video lectures teach everything from business communication to professional critical thinking skills. It’s a free resource that you should check out.

If you want more information about KPMG, feel free to contact your local office.

New York KPMG Contact Information

345 Park Avenue

New York, NY 10154

Phone: (212) 758-9700

Fax: (212) 758-9819

www.kpmg.com

History of the Big Four Firms

The big 4 weren’t always the only large accounting firms in the world. How the big four CPA firms were established is an interesting history that goes back over a hundred years, but let’s not go all the way back to the beginning. Let’s start with modern times. In the 1980s there were actually eight large firms known as the big eight. These firms were ranked in the following order.

- Arthur Andersen

- Arthur Young & Co.

- Coopers & Lybrand

- Ernst & Whinney

- Deloitte, Haskins & Sells

- KPMG

- Touche Ross

- Price Waterhouse

As you know, professional businesses like to merge and get bought out by other professional companies. That’s exactly what happened in 1989. Arthur Young merged with Ernst & Whinney and Touche Ross merged with Deloitte, Haskins & Sells reducing the big 8 accounting firms down to the big six.

The big six firms only lasted another 9 years until 1998 when Coopers & Lybrand merged with Price Waterhouse forming PwC. Now the big six accounting firms were reduced down to the big five.

The big five accounting firms only lasted another four years until 2002 when Arthur Andersen became caught in the Enron accounting scandal. AA’s image for integrity was severely damaged due to the negligence and securities fraud committed by Enron. They were sued by banks, investors, and other companies to recoup their losses and eventually had to disband. Many of the Andersen locations and clients were acquired by the remaining big four accounting firms.

Since 2002 there hasn’t been any other merger and the BIG 4 remain intact.

Become a Big Four CPA

It’s expected that you will become a CPA at one of the big 4 firms. Some of them have deadlines on when you have to pass the exam, while others strongly encourage your certification and hold your promotions until you actually get it.

Most firms actually want you to become a CPA within the first year of employment. This is no easy task. Starting a new job, learning the ropes of a big company, working through busy season, and trying to juggle the exam is tough, but it’s totally doable. You just need to find the right CPA review course and plow through it.

Here’s a resource I put together to show you the steps to becoming a CPA and passing the exam on your first try.

How to Land a Job with the Big 4

Getting hired by one of the Big Four firms is no easy task. You need to work hard and prove yourself. This goes for academics, extra circular actives, and professional experience. Remember, these firms know how good they are and know that thousands of people are fighting to work for them. They have earned the right to be picky and choose the best. It’s your job to be the best fit for them.

Notice I didn’t say you have to be the best to get hired by one of them. You just have to be the best fit. They want people who can think, solve problems, and communicate effectively. It’s not unheard of for these firms to turn away perfect 4.0 students for people with 3.2 GPAs. They don’t want to you to be a hermit who just studies all day long. They want you to be able to gain knowledge and experiences to help their clients and grow their practices. The best way to do that is to be well rounded and work on your communication skills.

Obviously, you will have to have an awesome resume and nail the interview, but you also need experiences and skills to back these things up. If you are still in college and want a Big Four Job, you should look at their internship opportunities. This is probably the easiest way to get hired.

Big 4 Accounting Firm Internships

Getting a big four internship is probably the easiest way to get hired by one of big firms. CPA firms don’t offer internships because they want cheap labor. In many cases they actually pay their interns more per hour than their actual first year associates. The entire point of an internship is to find and train qualified people with the intension of hiring them.

Why would a firm want to hire someone they have never worked with before over someone who has worked with them for three or four months? They wouldn’t. Think of an internship as a test out period. The firms hire interns and test them out to see if they will be a good fit to become a full time team member. It only makes sense, right?

It’s no wonder why firms hire more than 80 percent of their interns. Getting an internship is a foot in the door. As long as you work hard and don’t screw up the internship, you’re a shoe in to the big four accounting profession.

Big 4 Accounting Firm Salary

Okay, you are still in college and you’re thinking about getting in public accounting, but you aren’t really sure what it looks like or how much you will make. Getting a job at a big four accounting firm is definitely a good gig. You will get paid well and stay busy. When I say busy, I mean real busy. You’ll definitely be working more than 40 hours a week year round. Expect at least 50 to 60 hours a week during busy seasons.

Now how much can you expect to make? A CPA salary at a big 4 firm varies drastically depending on your location and services. For example, tax professionals and auditors typically have much different compensation than advisory team members. No matter what field you start with, you can expect to make a base salary of $50,000 as a first year associate. Each year you advance higher in the company and get promoted to Senior, Manager, Senior Manager, etc. you can expect to get a 15 to 17 percent raise.

With all of this averaged out, you should be able to make it to a Senior Partner position as soon as 15 years and have a healthy salary of $400,000 – $450,000. Obviously, these are just estimates and your location and position can vary, but needless to say you will be well taken care of if you choose to go into big four public accounting.

Top Accounting Firms to Work for

All of the big four firms are great places to work. They all consistently rank on Fortune’s top 100 best companies to work for every year. They tend to shift around within that list, but they always show up. The 2015 list has them ranked in the following order.

Big 4 Accounting Firms Rankings 2022

- KPMG: 63

- PricewaterhouseCoopers: 74

- Ernst & Young: 79

- Deloitte: 97

Although all of them made the list, none of them cracked to top 50 places. There are some firms that did actually rank higher on the list than the big four. For example, Plante & Moran is currently ranked number 29. It’s worth checking out all of your options when you are applying for jobs. Starting your career at one of the big four will give you great experience, but so will smaller firms like BDO and Plante & Moran.