A VAT invoice is used in countries that have a value added tax on goods. This tax system adds an extra tax to products during each manufacturing stage and process. As value is added to the product, it is taxed. Most countries in the European Union have a VAT system that requires invoices list a specific breakout of these taxes. You can think of this requirement similar to the break out of sales tax on most receipts.

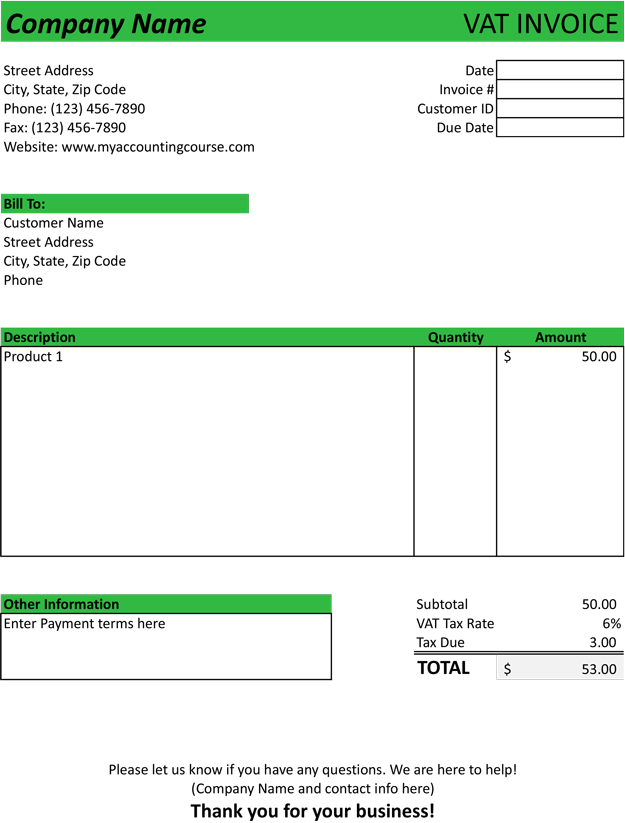

Chances are, if your business is not in the EU, you don’t need to worry about this and you won’t see a package that says this is not a VAT invoice. For other businesses that do work with companies inside the EU, here is a VAT invoice template that you can use when you ship your products. It’s an easy to edit excel document that includes the company information and places for product details and prices.