Definition: Unsystematic risk, also known as diversifiable risk or non-systematic risk, is the danger that relates to a particular security or a portfolio of securities. Investors construct diversified portfolios in order to allocate the risk over different classes of assets.

What Does Unsystematic Risk Mean?

What is the definition of unsystematic risk? Diversifiable risk is associated exclusively with factors related to a particular firm. For example, if a firm generates high profits, it can justify a higher stock price. Conversely, if a firm generates low profits, its stock price should be declining.

To reduce or eliminate this risk, investors diversify their portfolios by buying shares of different sectors, companies, and geographical regions. The greater the diversification, the lower the residual risk in the overall position. Unsystematic risk is measured and managed through the implementation of various risk management tools, including the derivatives market.

Let’s look at an example.

Example

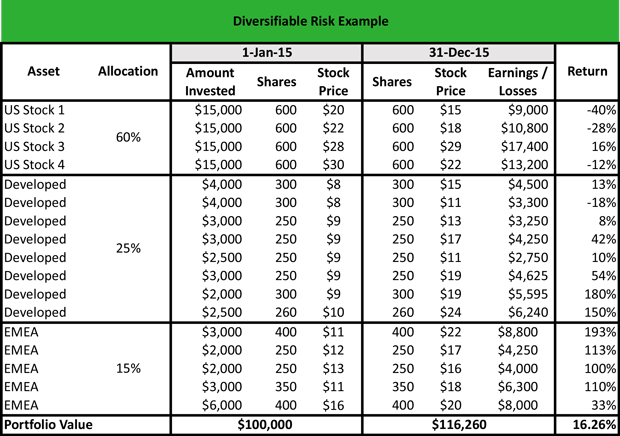

On January 1, 2015, Margaret invest $100,000 in a diversified portfolio that invests 60% in U.S. stocks, 25% in foreign stocks of developed economies, and 15% in emerging markets. On December 31, 2015, the value of the portfolio is $116,260, having incurred an annual growth of 16.26%.

As Margaret sees the annual breakdown of her investment, she notices that the U.S. stocks have incurred losses of 16% YoY. How is it possible to realize a return of 16.26% with 16% losses in the portfolio?

The basic concept of diversification is that even if some assets underperform the market, their losses are traded off by the outperformance of other assets in the portfolio. Therefore, if had invested only in U.S. stocks, she would have incurred 16% losses in the entire portfolio, as follows:

In contrast, by investing in a diversified portfolio, Margaret still incurs losses of 165 in the U.S. stocks, but she also realized 55% growth in the stocks of the developed economies and 117% growth in the emerging market stocks. Therefore, through diversification, Margaret spreads the investment over different classes of assets, thus eventually realizing a growth of 16.26% YoY.

Summary Definition

Define Unsystematic risk: Non systematic risk means the danger associated with only investing in one stock that might go up or down.