Definition: A tranche is a percentage of a structured debt product that seeks to spread the interest rate risk across various credit rating securities.

What Does Tranche Mean?

What is the definition of tranche? Tranches are commonly used in the collateralized debt obligations (CDOs), the asset-backed securities (ABS), the mortgage-backed securities (MBS), and the credit default swaps (CDs). All the products trade related securities with different credit ratings and maturities, seeking to allocate the investment risk in the different tranches.

For example, a mortgage-backed securities portfolio may include different mortgage tranches with different maturities and different risks. The main advantage of tranches is that they can include both junk and quality debt instruments, thereby rewarding investors with higher credit ratings. On the other hand, investors who cannot afford senior debt tranches and invest in the lower tiers are compensated only in the case that there is enough money left following the compensation of higher tiers. In the case of default, lower tranches may not even be compensated at all.

Let’s look at an example.

Example

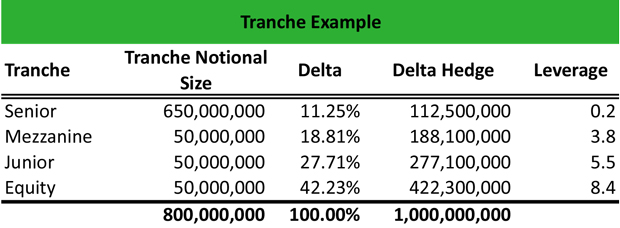

Tim works as an investment advisor at a boutique firm, and he is asked to structure a synthetic collateralized debt obligation (CDO) for one of the firm’s clients. The CDO involves 4 tranches, namely senior debt, mezzanine debt, junior debt, and equity as follows:

The total notional value of the CDO is $800 million. The delta ratio suggests that as the debt approaches maturity, and assuming no default on the portfolio, the delta of equity will increase closer to 100%, whereas the delta of the senior and mezzanine tranches will be closer to 0%. This happens because closer to maturity the senior tranches are less risky than the mezzanine or the junior tranches, thereby incurring a lower delta.

Summary Definition

Define Tranches: Tranche means a portion of a debt security.