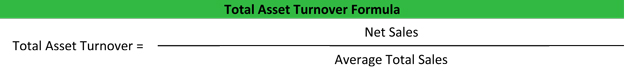

Definition: Total asset turnover is a financial efficiency ratio that measures the ability of a company to use its assets to generate sales. The total asset turnover ratio is calculated by dividing the net sales by the average total assets.

What Does Total Asset Turnover Ratio Mean?

Unlike other turnover ratios, like the inventory turnover ratio, the asset turnover ratio does not calculate how many times assets are sold. Instead, it looks at how efficiently assets are used.

Since company assets require a great deal of investment, management spends much of its time deciding what assets to purchase and when assets should be purchased or leased. Assets play a crucial role in a business’ ability to earn and generate income. For instance, a manufacturing plant wouldn’t be able to manufacture products without proper machinery and manufacturing equipment.

Example

Management uses the total asset turnover to judge how efficiently the company is using its assets to generate income. The numerator in the equation shows the income generated and the denominator shows the total assets used to generate the revenue.

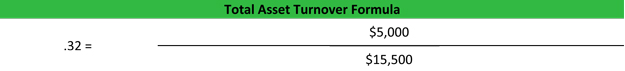

Take a manufacturing plant for example. This manufacturing plant has beginning total assets of $15,000 and ending total assets of $16,000. This makes the average total assets $15,500. The manufacturing plant produced $5,000 of net sales at the end of the year. Their total asset turnover would look like this.

As you can see, their asset turnover ratio is .32. The manufacturing plant “turned” its assets over .32 times or one third during the year. In other words, for every dollar that was invested in assets, the company generated $0.32 of net sales during the year.