Definition: Money supply refers to the amount of domestic currency that circulates in a national economy during a specified period. Money supply includes cash, coins, and money held in savings and checking accounts for short-term payments and investments.

What Does Money Supply Mean?

What is the definition of money supply? The money supply reflects the extent of liquidity that different money instruments have on an economy. Based on the size and type of account in which a liquid instrument belongs, money supply is broadly classified into M0, M1, M2 and M3.

Although these classifications do not apply to all countries, M0 and M1 is the narrowest classification that addresses the coins, notes and travelers’ checks that are in circulation. M2 includes the liquid instruments of M1 plus savings accounts, short-term deposits under $100,000, and certain money market funds. M3 includes the liquid instruments of M2 plus long-term banks deposits over $100,000 and institutional money-market funds.

Let’s look at an example.

Example

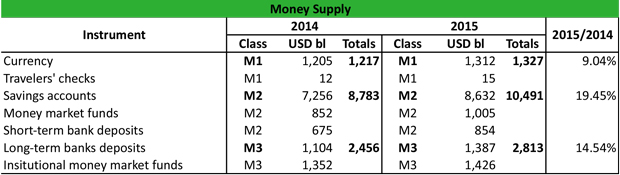

Aaron is an economist at the Federal Reserve, and he is asked to calculate the M for the U.S. economy over the past three years. The FED has conservations as to whether an increase in M would benefit the U.S. economy in the long-term. Aaron constructs the following table with data he collected from the Federal Reserve:

Aaron identifies an increase in all three M classifications, M1 9.04% YoY, M2 19.45% YoY, and M3 14.54% YoY. In M2 classification, money market funds have increased 18% YoY while in the M3 classification, long-term bank deposits have increased 25.6% YoY.

Overall, an increase in the supply in an economy leads to lower interest rates and higher consumer spending because the disposable income of consumers is higher. For instance, when the FED reduces the interest rate, banks can borrow money cheaper than before and can issue loans to consumers less expensively than before. Thus, more consumers take out loans and purchase houses and other goods.

Since consumers spend more, firms increase their output to meet consumer needs and consequently, their profits. At the same time, employment rises as more workers are hired due to the increase in production. On the other hand, an increase in the money supply often leads to higher inflation because as consumers spend more, the general level price rises.

Summary Definition

Define Money Supply: Money supply is an economic term for the amount of currency that is available in an economy or market.