Definition: Free Cash Flow (FCF) is a financial performance calculation that measures how much operating cash flows exceed capital expenditures. In other words, it measures how much available money a company has left over to pay back debt, pay investors, or grow the business after all the operations of the company have been paid for.

What Does Free Cash Flow Mean?

Contents [show]

Here is the free cash flow formula:

Earnings before Interest and Taxes (1-Tax Rate) + Amortization and Depreciation – Change in Net Working Capital – Capital Expenditure

What is the definition of free cash flow? It’s an effective tool for understanding how fast a company can grow and return value to shareholders. It also encompasses the Free Cash Flow to the Firm (FCFF), which represents the cash flows available both to shareholders and to creditors, and the Free Cash Flow to Equity (FCFE), which represents the cash flows that are available for future investments, loan settlements, and distribution to shareholders.

This measurement is also used in valuation. For the calculation of the value of a company, we use the discounted cash flow model (DCF), which discounts the FCF of the company to the weighted average cost of capital (WACC). Even if a company has negative cash flows, you should check if it invests heavily in opportunities that may earn a high return in the long-term.

Let’s look at an example.

Example

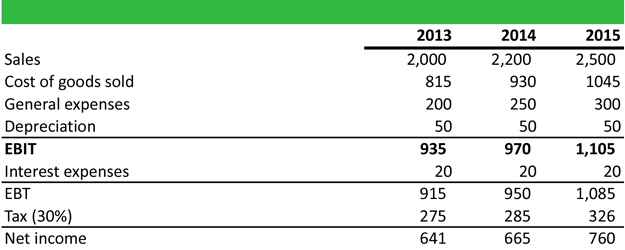

Adam wants to calculate the FCF of Company A. To do so, he has to determine the operating income for each year from 2013 to 2015. Here is part of Company A’s income statement for that time period:

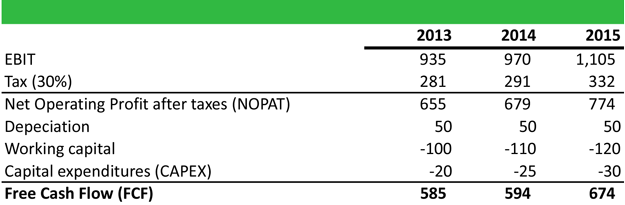

Then, he needs to calculate the FCF by deducting working capital and capital expenditures from EBIT as follows:

Positive FCF suggest that the company has the option to distribute its money to shareholders or to implement a buyout strategy. They also show that the management focuses on how to become more competitive.

Positive cash also increases investor confidence and willingness to invest in the company, thus, making the company more valuable to investors and increasing the stockprice.

Summary Definition

Define Free Cash Flow: FCF means a financial metric that managers and investors use to calcuate how much more money a company generates in profit than it spends on expenses.