Definition: The EV EBITDA ratio, also known as enterprise multiple, compares the enterprise value of a company to its EBITDA without considering changes in the company’s capital structure.

What Does EV EBITDA Mean?

Contents [show]

What is the definition of EV/EBITDA? Financial analysts use the EV/EBITDA ratio to measure a company’s value over its earnings. The metric is better than the P/E ratio because it considers the enterprise value irrespectively of the company’s capital structure. For instance, if a company raises additional capital through equity financing, the company’s P/E ratio will be higher because the price will rise.

However, the EV/EBITDA ratio does not consider such changes. In contrast, it calculates the company’s value compared to its earning power as well as to other similar companies in the sector, which may have different capital structures.

Let’s look at an example.

Example

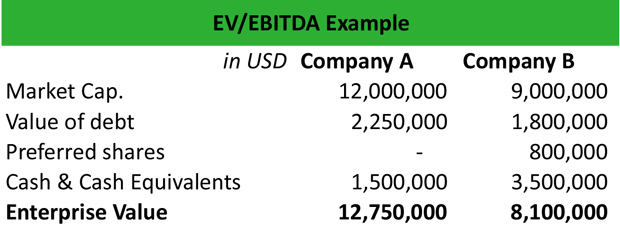

Jane wants to calculate the enterprise value of company A and compare it to the enterprise value of company B. To calculate the enterprise value, she needs to know the market capitalization, the value of debt, the minority interest, the preferred shares, and the cash and cash equivalents.

Therefore:

EV = market capitalization + value of debt + minority interest + preferred shares – cash and cash equivalents.

She creates an Excel spreadsheet as follows:

Company A has a market cap of $12 million, long-term debt of $2.25 million, and cash & cash equivalents of $1.5 million. Company B has a market cap of $9 million, long-term debt of $1.8 million, and $3.5 million in cash & cash equivalents. Also, company B has $800,000 preferred shares. Hence, the enterprise value of company A is $12.75 million, and the enterprise value of company B is $8.1 million.

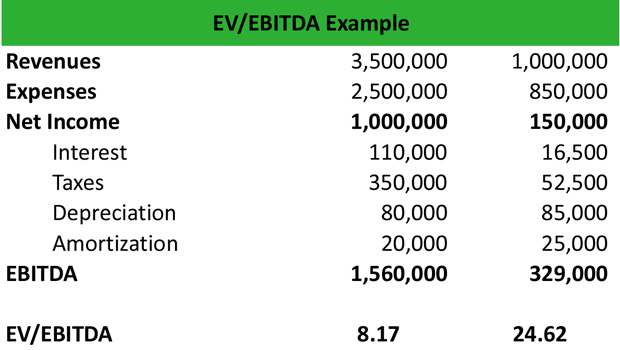

The next step is to determine the company’s EBITDA as follows:

Therefore:

Company A has an EVEBITDA ratio of 12,750,000 / 1,560,000 = 8.17

Company B has an EVEBITDA ratio of 8,100,000 / 329,000 = 24.62

Generally, a company with a low EV/EBITDA ratio is viewed as an attractive takeover target because the ratio reflects a low price for value for the company. Therefore, the acquirer will pay less for acquiring the company.

Summary Definition

Define EV-EBITDA: Enterprise multiple means a financial ratio that measures the value of a company by comparing the earnings before interest, taxes, depreciation, and amortization with enterprise value.