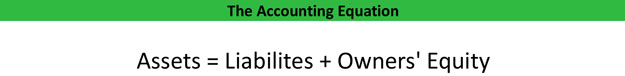

Definition: Equity, also called net assets, is the owner’s claim to company assets after the liabilities are paid off. The equity of a company can be calculated by subtracting the company liabilities from the company assets. This is why equity is commonly referred to as net assets or residual equity.

What Does Equity Mean?

What is the definition of owner’s equity? Equity equals the assets that are left over after the debts are paid.

Example

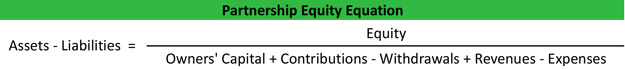

Depending on the entity, equity can be called a few different things. For instance equity in a partnership is called owner’s equity or capital. Partnership equity can increase by partner investments or contributions and revenues. Owner’s equity is decreased by partner withdrawals and expenses.

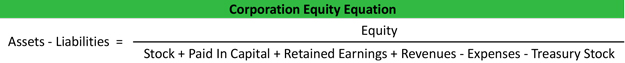

Corporation equity is divided into three main categories: stock, retained earnings, and paid in capital. Common stock is the most common form of corporation equity because every corporation must issue stock. This makes sense, although, stock does not account for the largest piece of owner’s equity.

Retained earning most often accounts for the largest dollar value of equity in a corporation. The retained earnings account is made up of the accumulated profits from past years that are still in the company.

Corporation equity can also take the form of additional paid in capital where stockholders pay more than the par value for their stock. Just like with partnership equity, corporation equity is increased by revenues and decreased by expenses.

Corporate equity does have one more component that partnership equity does not have. Corporations can buy back their shares from shareholders and issue treasury stock. This decreases owner’s equity because the company is actually taking away the shareholders’ ownership of the corporation.

Summary Definition

Define Equity: Equity refers to the amount of corporate assets that the shareholders own net of debt and liabilities. This is their interest in the company.