Definition: Earnings per share or EPS sounds pretty self explanatory, right? It’s the amount of earnings for each share of the company. Well, it is a little more complicated than that.

What Does EPS Mean?

Earnings per share is the amount of earning or net income that can be allocated to each outstanding common stock share. Make a note that only common stock is used for the calculation of earnings per share. Preferred stock is not taken into consideration. Preferred dividends are however taken into consideration because these reduce the amount of money available to common stock shareholders.

Think about it like this. If the company paid all of its expenses and preferred dividends, the remaining money left would be earnings that could be split up amongst the common stock shareholders because all the other company obligations have been taken care of.

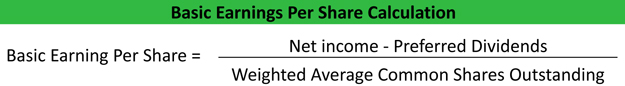

Earnings per share is the total dollar amount of earnings that can be given to each common stock after preferred dividends are paid. Remember, preferred stock dividends are generally paid before common stock dividends. This one of the advantages of owning preferred stock. This is how you calculate basic earnings per share.

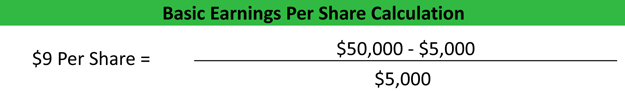

Let’s take a look at an example. We’ll assume that preferred stock is cumulative just to keep it simple. In 2013, Green Guitar, Inc. had net income of $50,000. The board of directors declared a $5,000 preferred dividend. GGI has 5,000 common stock shares outstanding during 2013. Here is how to calculate GGI’s basic earnings per share.

Download this Download an excel version of this example to help calculate your own Earnings per Share problems.

The $9 of earnings per share would be reported on the income statement below net income or net earnings.