Definition: A diversified portfolio is a portfolio constructed of investment products with different risk levels and yields, which seeks to lower the assumed risk and leverage a significant percentage of the variability of the portfolio performance.

What Does Diversified Portfolio Mean?

Contents [show]

What is the definition of diversified portfolio? The portfolio diversification tries to level out the impact of systemic and unsystematic risk and assume the losses that may result from poor performances of individual investments. Rational investors select a proper allocation of assets to match their investment profile (aggressive or conservative) and maximize the return on their portfolio.

Usually, aggressive investors assume a higher level of risk, expecting higher returns, whereas conservative investors seek to preserve their earnings and maintain the value of their portfolio. Nevertheless, investing in different classes of assets allows investors to expand into international markets or different sectors and potentially lower their portfolio risk.

Let’s look at an example.

Example

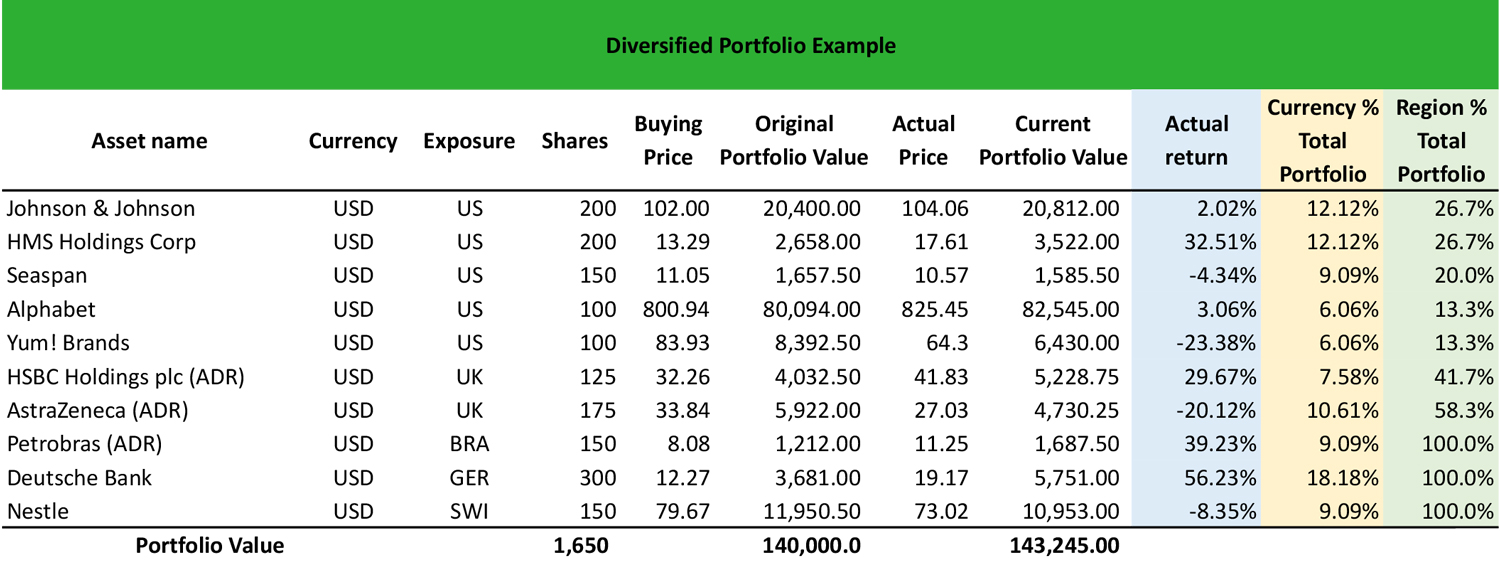

Mary invests $140,000 in a portfolio, consisting of ten stocks that trade in different sectors, currencies, and geographical regions. To avoid currency risk, Mary has invested in ADRs, which allow her to buy stocks that trade in foreign stocks exchanges in USD. So, Mary has invested in Petrobras Brazil, HSBC Holdings and AstraZeneca UK, Deutsche Bank Germany, and Nestle Switzerland.

The original total value of her portfolio is $140,000 and the current value of her portfolio is $143,245. So, Mary has realized a profit of $3,245, or a portfolio return of 2.32%. Some of the stocks in the portfolio have incurred losses (Seaspan, Yum! AstraZeneca, Nestle), whereas HMS, Petrobras, HSBC, and Deutsche Bank, all have high returns.

To calculate the currency exposure, Mary divides the number of shares she owns on each investment by the total number shares. Hence, 200 shares of Johnson & Johnson over 1,650 total shares equals 12.12%; 150 shares of Seaspan over 1,650 total shares equals 9.09%; and so on. To calculate the geographical exposure, Mary adds the shares that trade in the US stock market (750), the shares that trade in the UK (300), and she has 100 stocks in Brazil, Germany, and Switzerland. Therefore, the exposure of Johnson & Johnson is 26.7% (200 shares over 750); of HSBC is 41.7% (125 shares over 300); and so on.

Summary Definition

Define Diversified Portfolios: Portfolio diversification means investing in multiple different asset classes and risk levels in an effort to mitigate overall investment risk.