Definition: Deferred tax asset indicates the situation where a firm has paid additional taxes or taxes in advance, which the company then claims as a tax relief amount.

What Does Deferred Tax Asset Mean?

What is the definition of deferred tax asset? A deferred tax asset is an income tax created by a carrying amount of net loss or tax credit, which is eventually returned to the company and reported on the company’s balance sheet as an asset. Companies use tax deferrals to lower the income tax expenses of the coming accounting period, provided that next tax period will generate positive earnings.

For example, a company that pays a tax rate of 35% depreciates its equipment that has a value of $25,000 and a life of 5 years. In Year 2, the company records the straight-line depreciation of $5,000 and a tax of $10,000 in its books. Normally, the company would pay a tax of $8,750. The difference between the accounting value of the equipment and the tax paid is the deferred taxes.

Let’s look at an example.

Example

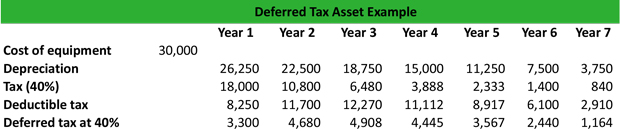

Company XYZ is a manufacturer of trade mills. The company has recently expanded its operations. The management has decided the purchase of new equipment for 8 years for a cost of $30,000. The company pays a tax rate of 40%.

From Year 1 to Year 7, the straight-line depreciation is higher than the tax paid, which indicates that the company claims a tax depreciation deduction in excess of the cost of equipment. Therefore, the company has a deferred tax liability. In the coming tax period, the company will claim the accounting depreciation minus the tax depreciation.

In Year 8, the straight-line depreciation is lower than the tax paid, and the company recognizes a deferred tax asset, suggesting that in the coming tax period it expects to claim accounting depreciation in excess of tax depreciation.

Summary Definition

Define Deferred Tax Asset: Deferred tax asset means a company prepays taxes up front, so it doesn’t have to pay this amount of taxes in the future.