Definition: The date of payment is the day that a company actually pays its dividends. Remember on the date of declaration, the board of directors only declares or decides to issue a dividend. The company doesn’t actually pay the dividend on that day. The dividend isn’t actually paid until the date of payment. Sounds pretty logical right? The time between the date a dividend is declared and actually paid could be as little as a week or as long as a few months.

What Does Date of Payment Mean?

Contents [show]

After dividends are declared, the company has to record all of the shareholders that will get the dividend. This is called the date of record. Soon after the date of record, usually within a few days, the company issues the dividend payments to the shareholders in forms of checks, direct deposits, and wire transfers.

The main reason for the delay in payment is for the company to organize its funds, record the current shareholders, and manage the logistics of sending out thousands or even millions of payments.

Example

You might wonder if dividends really influence the stock price with this kind of time delay from declaration to payment. Well, it depends. Many times a single dividend won’t really affect the stock price. Companies like GE that give regular dividends help maintain stock demand among investors with its regular dividends.

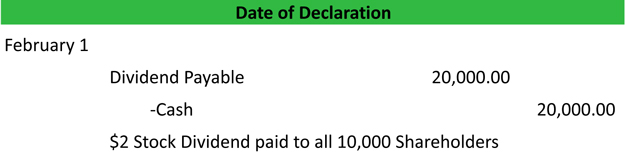

By paying the dividend, the company repays of the debt owed to the shareholders. Here is an example of a journal entry on the date that a cash dividend is paid.

Date of Payment General Journal Entry Example

Here is an example journal entry on the date of payment.

Download this Download an excel version of this example