Definition: A bank reconciliation or bank rec is a report used to check and explain the differences between the cash balance in a company’s accounting ledger and the bank statement balance. A bank reconciliation is also one of the main ways to prevent fraud and embezzlement of company funds. Here is how it works.

What does Bank Reconciliation Mean?

Let’s take Fender Guitar Company for example. Throughout the course of business, Fender writes checks to vendors for goods and services. These checks are recorded as expenses (cash out) in Fender’s accounting system as soon as the checks are written. Fender also receives checks from customers and dealers who are buying their guitars. These checks are recorded as income (cash in) as soon as the checks are received.

Notice how none of the checks have made it to the bank account yet? The checks Fender wrote to vendors won’t actually be withdrawn from Fender’s bank account until the vendors actually receive and cash them. The checks Fender received from customers won’t actually appear in Fender’s bank account until they are cashed and the bank clears them.

This disconnect between Fender’s accounting records and what is actually in the Fender bank account is called the bank statement difference or ledger different. The two balances won’t be the same until all the outstanding checks that Fender wrote vendors are cashed and the checks Fender received from customers or deposits in transit are cleared. In an ideal world, the bank statement balance the accounting ledger balance would always be the same, but they rarely are.

Example

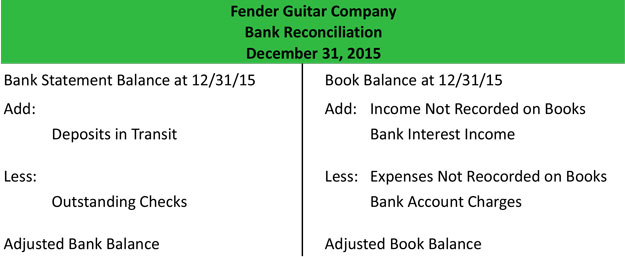

A bank reconciliation checks the accuracy of both records: the bank statement and the accounting records. Basically, a bank reconciliation has two column: one for all the bank statement transactions and one for all the accounting record transactions. Each transaction is matched and checked off to see what checks are outstanding and what deposits are in transit.

Once the bank statement balance is adjusted for deposits in transit and outstanding checks and the book balance is adjusted for bank account activity not recorded in the accounting system, the two adjusted balances should be equal. Here is what an example bank reconciliation looks like.

Download this accounting example in excel.