Definition: A balanced fund is a hybrid mutual fund that combines different securities, including stocks, bonds and money market funds, aimed at achieving a higher return while leveraging portfolio risk.

What Does Balanced Fund Mean?

What is the definition of balanced fund? Balanced funds may be oriented towards equity or fixed-income. Equity funds seek to generate growth, but also to hedge investment risk; therefore, risk taking investors invest in equity-oriented funds, seeking growth and higher returns.

Income funds seek to generate a stream of income, but also to achieve capital appreciation; therefore, risk-averse investors who are not willing to undertake excessive risk, invest in fixed-income oriented funds to create a steady stream of income while leveraging portfolio volatility.

Let’s look at an example.

Example

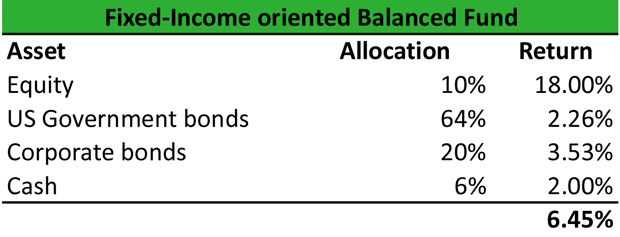

Jerry is a risk-averse investor. He doesn’t like excessive risk, and he is conservative with his investment choices. He holds a diversified fund with a high fixed-income component consisting of 64% US government bonds, 20% corporate bonds while the remaining 16% is equity and cash. The average return of Jerry’s fixed-income oriented balanced fund is 6.45%.

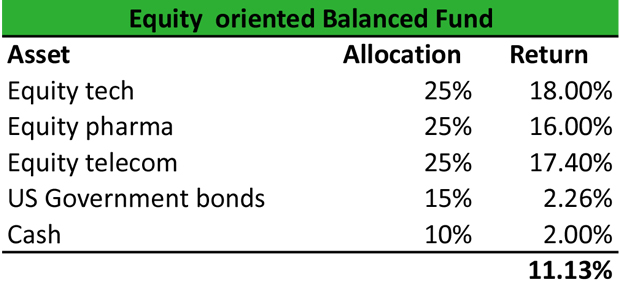

Jerry’s brother, Max, is a risk taker investor. He is willing to accept excessive risk aiming for higher portfolio returns. He holds a diversified fund with a high equity component consisting of 75% equity spread over technology, pharmaceutical and telecom stocks, 15% of US government bonds, and 10% cash. The average return on Max’s equity-oriented balanced fund is 11.13%.

Both investors are seeking to protect their capital. In the case of Jerry, the creation of a steady income stream is more important than high returns; therefore, Jerry invests in a fixed-income oriented fund. In the case of Max, the creation of a higher income as a result of high returns is more important than preserving his capital; therefore, Max invests in an equity-oriented fund.

Summary Definition

Define Balanced Fund: Balanced funds are diversified mutual funds that contain bonds, stock, and other securities designed to limit risk and increase returns.