Definition: Arbitrage is an investment technique that purchases and sells an investment at the same time to profit from price fluctuations. This is a common practice with securities in many financial markets.

What Does Arbitrage Mean?

Contents [show]

What is the definition of arbitrage? Arbitrage offers a risk-free return, and it is usually applied by arbitrageurs who seek to realize an immediate profit from an asset that trades in more than one exchanges. Given that the markets are imperfect, arbitrage capitalizes on the imperfect distribution of information and offers a net profit after the trading costs are subtracted. Hence, to implement arbitrage, the arbitrageur should be certain that the potential gain is higher than the costs involved in the process.

Let’s look at an example.

Example

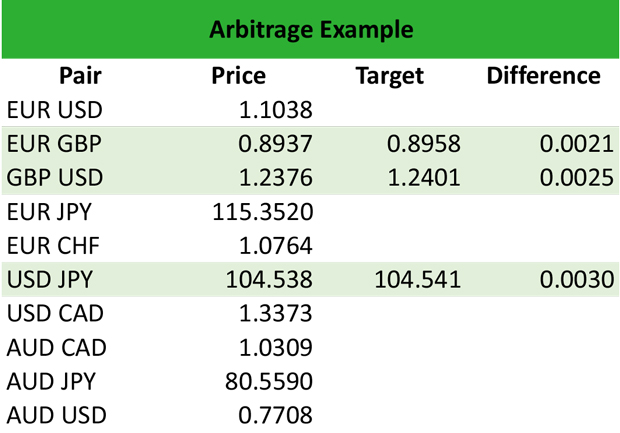

Sandro is a forex trader. He follows the forex market daily, seeking for arbitrage opportunities stemming from the differences in the exchange rates. So, he has created an Excel spreadsheet, where he inputs the prices of certain exchange rates, and then he determines whether to enter an arbitrage trade or not.

Here is how the Excel spreadsheet looks like:

He has three pairs of currencies that he is interested in, and he has set a target price in three of them. Once the exchange rate hits the target, Sandro will simultaneously buy EUR and sell GBP to realize a profit from the difference in the exchange rate.

Because he will sell and buy simultaneously, the trade incurs no market risk. So, Sandro hopes that the market will reach the locked-in prices he has determined for his arbitrage trade, thereby unwinding the trade and realizing an easy profit.

Of course, arbitrage can be more complicated that this simple forex example. In addition, it required a rapid execution of the trade for the strategy to be successful.

Summary Definition

Define Arbitrage Opportunity: Arbitrage means a strategy that takes advantage of price inefficiencies to realize a profit from buying and selling an asset at the same time.