Definition: Actual costing is a cost accounting system that uses actual cost, direct-cost rates, and actual qualities used in production to determine the cost of specific products. Usually an actual costing system traces direct costs to a cost object or something that has a measurable cost.

In other words, managers go back to the source of the costs (cost objects) like labor and materials. Managers can analyze how many hours of manufacturing time a product requires to calculate the actual costs of producing that product.

What Does Actual Costing Mean?

Contents [show]

Actual costing is a fundamental method in cost accounting, allowing businesses to track and evaluate the real expenses associated with production.

Actual costing is a fundamental method in cost accounting, allowing businesses to track and evaluate the real expenses associated with production.

Unlike standard or budgeted costing methods, actual costing relies on real-time data, providing an accurate picture of production expenses.

This approach is crucial for businesses aiming to understand their cost structure and improve profitability.

Example

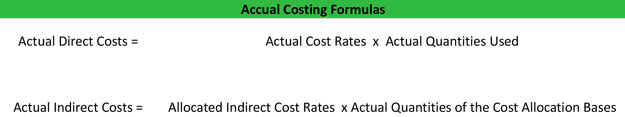

Managers can use these formulas to calculate the total production costs. For instance, managers first need to find out how many hours it took the company to produce the product and how much the company is paying its employees per hour. Using the first actual costing formula, these numbers make up the labor portion of the production costs. The same is done for materials. Overhead is a little different.

Since overhead like utility usage is a little difficult to assign to a single product, managers usually make estimates. They estimate how much overhead was used and how long the overhead was used. Using the second actual costing formula, management can determine the indirect productions costs for producing the product. After all the calculations are done, add up the totals and you’ll get the actual cost of producing your product.

After the actual cost is known, management can change the production process in order to meet budget goals.

The Importance of Actual Costing

Actual costing provides invaluable insights into the true costs of production. By relying on real numbers instead of estimates, businesses can make informed decisions about pricing, budgeting, and resource allocation.

For instance, a furniture manufacturer using actual costing can determine the exact cost of producing a table, including the wood, glue, labor hours, and machine usage. This level of detail helps the company assess whether the product is profitable and identify areas where costs can be reduced.

Here are the typical actual costing system formulas:

Components of Actual Costing

Direct Costs

Direct costs include expenses that can be directly traced to the production of a specific product. These typically encompass materials and labor. For example, the cost of metal used to produce a car is a direct cost.

Indirect Costs (Overhead)

Indirect costs are not directly tied to a single product but are necessary for production, such as utilities, maintenance, and factory rent. Assigning these costs accurately requires careful analysis and allocation methods.

Quantity of Usage

Actual costing incorporates the actual quantities of materials and labor used in production. This requires detailed tracking to ensure accuracy.

How to Calculate Actual Costing in Accounting

The process of calculating actual costs involves three main steps:

Determine Direct Material Costs

Identify the quantity and price of materials used. For example, if 100 units of material costing $5 each are used, the total direct material cost is $500.

Calculate Direct Labor Costs

Multiply the number of labor hours by the hourly wage rate. If 20 hours are worked at $15 per hour, the direct labor cost is $300.

Allocate Overhead Costs

Use an appropriate allocation base, such as machine hours or labor hours, to assign overhead costs to the product. If 10 machine hours are used at an overhead rate of $10 per hour, the overhead cost is $100.

Adding these components gives the total actual cost of production.

Advantages of Actual Costing

Accuracy

Actual costing provides precise information by relying on real data. This helps businesses avoid the inaccuracies inherent in budgeted or standard costing.

Informed Decision-Making

Managers can use actual cost data to identify inefficiencies and make data-driven decisions to improve production processes.

Flexibility

Actual costing adapts to changing conditions, such as fluctuating material prices or labor rates, offering a more dynamic approach to cost management.

Challenges of Actual Costing

While actual costing has many benefits, it also comes with challenges:

Complexity: Tracking real-time data for materials, labor, and overhead can be resource-intensive, especially for large organizations with multiple production lines.

Time-Consuming: The detailed data collection and analysis required for actual costing can be time-consuming, delaying decision-making in fast-paced environments.

Dependence on Accurate Data: Inaccurate or incomplete data can compromise the reliability of actual costing calculations, leading to poor decisions.

Applications of Actual Costing in Industries

- Manufacturing: In manufacturing, actual costing is widely used to track the real costs of producing goods. This helps companies determine pricing strategies and identify cost-saving opportunities.

- Construction: Construction firms use actual costing to monitor expenses for materials, labor, and equipment on a project-by-project basis.

- Retail: Retailers rely on actual costing to evaluate inventory costs and assess the profitability of individual product lines.

- Healthcare: Hospitals and clinics use actual costing to calculate the true cost of patient care, including medical supplies, labor, and facility usage.

Case Study: Actual Costing in a Food Processing Plant

A food processing company produces packaged snacks and uses actual costing to monitor its expenses. The company tracks the cost of ingredients, such as flour and sugar, as well as packaging materials and labor hours.

At the end of the month, the actual costs are calculated as follows:

- Direct Materials: $20,000 (based on ingredient usage).

- Direct Labor: $15,000 (based on hours worked and wages).

- Overhead: $10,000 (allocated based on machine hours).

The total actual cost for the month is $45,000. Comparing this figure to the budgeted cost of $50,000 reveals a $5,000 savings, prompting management to analyze which efficiencies contributed to the lower expenses.

Strategic Implications of Actual Costing

Budgeting and Forecasting

Actual costing data serves as a benchmark for creating more accurate budgets and forecasts.

Cost Control

By identifying cost drivers and inefficiencies, businesses can implement targeted cost-saving measures.

Pricing Strategies

Understanding the true cost of production enables businesses to set competitive prices while maintaining profitability.

Frequently Asked Questions

What is actual costing?

Actual costing is a cost accounting method that calculates the exact cost of production using actual expenses for materials, labor, and overhead. It provides precise data by relying on real-time cost tracking rather than estimates.

How does actual costing differ from standard costing?

Actual costing uses real data for expenses incurred during production, while standard costing relies on pre-determined estimates. Actual costing offers greater accuracy but is more time-intensive.

What are the main components of actual costing?

The primary components of actual costing are direct material costs, direct labor costs, and allocated overhead costs. These elements collectively determine the total cost of production.

Why is actual costing important for businesses?

Actual costing helps businesses accurately assess production costs, set competitive pricing, and identify inefficiencies. It supports better decision-making by providing a realistic view of financial performance.

Bottom Line

Actual costing is a critical tool in cost accounting, offering businesses an accurate view of their production expenses. By incorporating real data on materials, labor, and overhead, actual costing enables better decision-making, cost control, and strategic planning.

While the process can be complex and time-consuming, the insights gained from actual costing far outweigh the challenges, making it an indispensable method for businesses across industries. As organizations continue to prioritize efficiency and profitability, actual costing will remain a cornerstone of effective financial management.