Definition: The accounting rate of return (ARR), also called the simple or average rate of return, is an investment formula used to measure the annual earnings or profit an investment is expected to make. In other words, it calculates how much money or return you as an investor will make on your investment.

Definition: The accounting rate of return (ARR), also called the simple or average rate of return, is an investment formula used to measure the annual earnings or profit an investment is expected to make. In other words, it calculates how much money or return you as an investor will make on your investment.

What Does Accounting Rate of Return Mean?

Contents

What is the definition of accounting rate of return?

The Accounting Rate of Return (ARR) is a straightforward yet valuable metric for assessing the profitability of an investment. It provides a snapshot of expected returns relative to the initial investment cost, making it an essential tool for individuals and businesses evaluating where to allocate resources.

While it has its strengths, understanding its limitations and comparing it to other return metrics is crucial for making well-informed decisions.

ARR is an important calculation because it helps investors analyze the risk involved in making an investment and decided whether the earnings are high enough to accept the risk level.

This Most people and companies have some types of investments. Whether the investments are short-term CDs or long-term retirement plans, investments play a big role in Americans’ lives. The only way to tell whether an investment is worthwhile or not is to measure the return or amount of money the investment has made and is expected to make in the future. To do this we must know how to calculate the accounting rate of return.

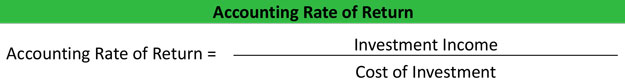

The accounting rate of return formula is calculated by dividing the income from your investment by the cost of the investment. Usually both of these numbers are either annual numbers or an average of annual numbers. You can also use monthly or even weekly numbers. The time length doesn’t matter.

Let’s take a look at an example.

Example

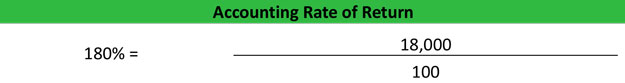

Let’s assume that you invested $100 into your racecar. After making the investment, you won $18,000 in prizes. Your ARR would be:

Obviously, this is a huge return and a racecar isn’t your typical investment. This great return might have had more to do with your driving abilities than the actual investment, but the principle is the same. I would still tell you to keep putting money into your racecar with returns like this.

Why Is ARR Important?

ARR is often used because it is simple to calculate and easy to interpret. Unlike more complex metrics such as Net Present Value (NPV) or Internal Rate of Return (IRR), ARR requires only basic financial data—investment cost and expected annual returns.

For example, if a company is deciding between purchasing new equipment or investing in a marketing campaign, ARR can quickly show which option is expected to yield a higher return. This simplicity makes it particularly useful for small businesses or investors with limited analytical resources.

The ARR Formula

ARR is calculated using the formula:

ARR = (Average Annual Accounting Profit / Initial Investment) × 100

Here’s how each component is defined:

- Average Annual Accounting Profit: This is the average income generated by the investment over its useful life, accounting for expenses such as depreciation.

- Initial Investment: This is the total upfront cost of the investment, including purchase price, installation, and any other related expenses.

The result is expressed as a percentage, providing a clear measure of profitability.

Example: Applying ARR in Practice

Consider a bakery that is evaluating the purchase of a new oven costing $10,000. The oven is expected to generate $3,000 in additional profit annually over its 5-year lifespan. The average annual profit is straightforward: $3,000.

Using the formula:

ARR = (3,000 / 10,000) × 100 = 30%

This means the bakery can expect a 30% return on its investment each year. With such a high ARR, the bakery may decide to proceed with the purchase, assuming other factors like cash flow and risk are also favorable.

Advantages of ARR

ARR offers several benefits that make it a popular choice for initial investment screening:

Simplicity: Its calculation is easy to understand, making it accessible for non-financial stakeholders.

Focus on Accounting Profits: By using accounting figures, ARR aligns with financial reporting, ensuring consistency in decision-making.

Quick Comparisons: ARR allows investors and managers to compare multiple projects or investment opportunities easily.

For instance, a manufacturing firm evaluating two machinery upgrades can use ARR to identify which option offers a higher return, streamlining the decision-making process.

Limitations of ARR

Despite its usefulness, ARR has notable limitations:

Ignores the Time Value of Money (TVM): ARR does not account for the fact that money earned today is more valuable than money earned in the future. This makes it less suitable for evaluating long-term projects with delayed returns.

Excludes Cash Flows: ARR focuses solely on accounting profit, which includes non-cash items like depreciation, rather than actual cash inflows.

Simplistic Approach: Its reliance on averages can oversimplify complex projects with fluctuating returns.

For example, a construction company investing in a project with irregular cash flows may find ARR inadequate for capturing the investment’s true financial dynamics.

ARR vs. Other Return Metrics

While ARR is a useful starting point, comparing it to other metrics provides a more comprehensive view of an investment’s profitability:

- Net Present Value (NPV): Unlike ARR, NPV accounts for the time value of money, making it more accurate for long-term investments. However, NPV is more complex to calculate and requires assumptions about discount rates.

- Internal Rate of Return (IRR): IRR also considers the time value of money and provides a percentage return like ARR, but it focuses on cash flows rather than accounting profits.

- Payback Period: This metric calculates the time required to recover the initial investment but does not provide a profitability percentage like ARR.

For example, a tech company launching a new product might use ARR for a quick profitability estimate but rely on NPV and IRR for detailed financial modeling.

Practical Applications of ARR

ARR is particularly valuable in industries where investments are frequent and need rapid assessment.

- Retail: Retailers often use ARR to evaluate store upgrades, inventory expansions, or new product lines.

- Small Businesses: Small business owners rely on ARR for its simplicity when deciding on equipment purchases or marketing initiatives.

- Short-Term Projects: ARR is well-suited for projects with short time horizons, where the time value of money is less significant.

For example, a coffee shop considering adding outdoor seating might use ARR to estimate profitability and decide whether the investment aligns with its budget.

Enhancing Decision-Making with ARR

While ARR alone is not sufficient for making final investment decisions, it can be combined with other tools for a more robust analysis.

For instance, businesses can use ARR as a screening tool to identify high-potential projects and then apply NPV or IRR for a deeper evaluation. This layered approach ensures that decisions are both efficient and well-informed.

Summary Definition

Define Accounting Rate of Return: ARR means the percentage income that an investment will make over a period of time calculated by dividing the investment income by the investment cost.

Frequently Asked Questions

What is the Accounting Rate of Return (ARR)?

The Accounting Rate of Return (ARR) measures the profitability of an investment by dividing the average annual accounting profit by the initial investment cost. It provides a percentage return, helping investors assess an investment’s financial viability.

How is ARR calculated?

ARR is calculated using the formula: \( \text{ARR} = \frac{\text{Average Annual Accounting Profit}}{\text{Initial Investment}} \times 100 \). This gives a percentage that reflects the expected return on an investment.

What are the advantages of using ARR?

ARR is simple to calculate and easy to understand, making it accessible for quick investment evaluations. It aligns with accounting figures, enabling businesses to compare projects based on profitability.

What are the limitations of ARR?

ARR does not account for the time value of money or focus on cash flows, which can lead to incomplete evaluations for long-term investments. It also relies on averages, potentially oversimplifying projects with fluctuating returns.

Bottom Line

The Accounting Rate of Return is a simple yet powerful metric for evaluating investment profitability. Its ease of use and alignment with accounting figures make it a popular choice for businesses and investors alike.

However, ARR’s limitations—such as ignoring the time value of money and cash flows—highlight the importance of using it alongside other financial metrics. By understanding its strengths and weaknesses, businesses can leverage ARR effectively, ensuring that their investment decisions align with their financial goals and risk tolerance. Whether for a small bakery or a large corporation, ARR remains an essential tool in the arsenal of financial decision-making.