Definition: The account form balance sheet is a financial statement format where the assets are reported on the left side and the liabilities and equity are reported on the right side. The account format is kind of a visual representation of the accounting equation.

The assets are listed on the left alone. The liabilities and owner’s equity are added together and listed on the right. Both the left and right sides are totaled at the bottom of the report and must always equal each other. Just like the accounting equation (assets = liabilities + owner’s equity).

What Does Account Form Balance Sheet Mean?

Contents [show]

The account form balance sheet is one of the fundamental formats used to present a company’s financial position. Its layout, which mirrors the accounting equation (Assets = Liabilities + Owner’s Equity), provides a side-by-side view of a company’s resources and the claims against those resources. This horizontal arrangement is both practical and visually intuitive, allowing users to quickly verify that the equation remains balanced.

The account form balance sheet is one of the fundamental formats used to present a company’s financial position. Its layout, which mirrors the accounting equation (Assets = Liabilities + Owner’s Equity), provides a side-by-side view of a company’s resources and the claims against those resources. This horizontal arrangement is both practical and visually intuitive, allowing users to quickly verify that the equation remains balanced.

The account format is not the only acceptable way to present a balance sheet, however. The report format vertically aligns the asset, liability, and equity accounts with the descriptions on the left and the account totals on the right.

Although both presentation formats are acceptable for GAAP purposes, companies and accountants usually prefer the report form balance sheet because it’s easier to read especially when multiple comparative years are presents. The vertical arrangement of the report form can easily report both years side by side.

This doesn’t mean the account form isn’t used though. Many financial statement users prefer this presentation because it separates the assets more clearly.

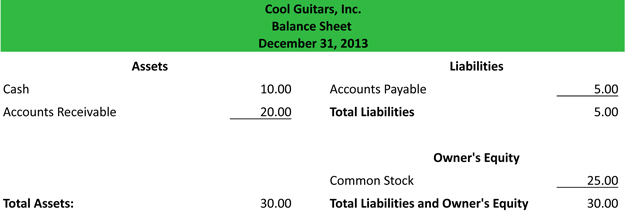

Example

Let’s take a look at an example balance sheet.

As you can see, the account form lists all of the assets in order of liquidity on the left side. First current assets are presented followed by the non-current assets with a total at the bottom.

The liabilities are listed and totaled on the right hand side and followed by the equity accounts. Notice that both liabilities and equity are totaled individually and then combined. The combined liabilities and equity total must always equal the assets total on the left as per double entry accounting.

The Structure of the Account Form Balance Sheet

In the account form balance sheet, the left side lists all assets, typically arranged in order of liquidity. Liquidity refers to how quickly an asset can be converted into cash. For example, current assets like cash, accounts receivable, and inventory are listed before non-current assets like property, plant, and equipment.

On the right side, liabilities are listed first, followed by owner’s equity. Liabilities, which represent obligations to creditors, are further divided into current liabilities (such as accounts payable and accrued expenses) and non-current liabilities (like long-term loans). Owner’s equity reflects the residual interest in the company’s assets after liabilities are deducted and typically includes accounts like retained earnings and common stock.

Both sides are totaled at the bottom, and as per the principles of double-entry accounting, the totals must always be equal.

Why Use the Account Form Balance Sheet?

The account form balance sheet is favored for its ability to visually reinforce the accounting equation. This format makes it easier for users to understand the relationship between assets and the sources of funding (liabilities and equity).

For instance, investors analyzing a company might prefer this format because it highlights the balance between debt and equity financing. A glance at the right side can show whether a company relies more heavily on borrowed funds or owner contributions to support its operations.

Comparing the Account Form and Report Form Balance Sheets

While the account form offers a clear representation of the accounting equation, the report form balance sheet presents the same information in a vertical layout. In the report form, assets are listed first, followed by liabilities and equity, with totals appearing at the bottom.

The vertical arrangement of the report form is particularly useful for presenting comparative data across multiple years. For example, a report form balance sheet can display side-by-side columns for 2023 and 2022, allowing users to easily compare changes in financial position.

In contrast, the account form is more static, focusing on the relationship between assets and their financing sources. While this horizontal format is less common in modern financial reporting, it remains relevant in specific contexts, such as internal management reports or presentations.

Practical Applications of the Account Form Balance Sheet

Despite the growing preference for the report form, the account form continues to serve various purposes:

Educational Contexts: The account form is often used in accounting textbooks and courses to teach the basics of financial statements. Its alignment with the accounting equation makes it an effective teaching tool for illustrating fundamental principles.

Small Businesses and Internal Reporting: Smaller organizations that rely on simple accounting systems may use the account form for internal purposes. This format can be easier to prepare manually and provides a clear snapshot of financial position.

Custom Financial Reports: Certain industries or stakeholders may prefer the account form for specific analyses, such as examining the relationship between asset types and funding sources.

Historical Significance of Account Form Balance Sheets

The account form balance sheet has historical roots in the development of accounting systems. Early accounting records often mirrored this horizontal format, reflecting the dual-entry nature of bookkeeping. While modern software and reporting standards have shifted preferences toward the report form, the account form retains its relevance as a foundational representation of financial data.

The Role of Software in Balance Sheet Preparation

Advancements in accounting technology have made it easier for businesses to prepare both account form and report form balance sheets. Software platforms like QuickBooks and Xero allow users to generate financial statements in various formats with minimal effort. These tools also enable real-time adjustments, ensuring that both sides of the balance sheet remain accurate and balanced.

For example, when a company records a new loan, the system automatically updates the Cash account (an asset) on the left side and the Loans Payable account (a liability) on the right side. This automation ensures compliance with the principles of double-entry accounting and reduces the risk of errors.

Limitations of the Account Form Balance Sheet

While the account form has advantages, it is not without limitations. One challenge is its inefficiency in presenting comparative data. When multiple years or entities need to be analyzed, the horizontal layout can become unwieldy, making the report form a more practical choice.

Additionally, the account form may be less familiar to external stakeholders, such as investors or auditors, who are accustomed to seeing financial statements in the vertical report format. Businesses should consider their audience when deciding which format to use.

Frequently Asked Questions

What is an account form balance sheet?

An account form balance sheet is a financial statement that presents assets on the left side and liabilities and equity on the right side. It visually reflects the accounting equation: Assets = Liabilities + Owner’s Equity.

How does an account form balance sheet differ from a report form balance sheet?

The account form uses a horizontal layout to separate assets from liabilities and equity, while the report form lists all accounts vertically. The report form is often preferred for its readability and ability to present comparative data.

What are the advantages of using an account form balance sheet?

The account form provides a clear visual representation of the accounting equation, making it easier to analyze the relationship between assets and their funding sources. It is especially useful for internal reporting and educational purposes.

Is the account form balance sheet still commonly used in financial reporting?

While less common than the report form, the account form is still used in specific contexts like small businesses, internal reports, or accounting education. Both formats are acceptable under GAAP and IFRS guidelines.

Bottom Line

The account form balance sheet remains a vital representation of financial data, offering a clear and logical depiction of the accounting equation. By presenting assets on the left and liabilities and equity on the right, it reinforces the principles of double-entry accounting and provides a snapshot of a company’s financial position.

Although the report form has gained popularity for its flexibility and ease of comparison, the account form continues to play an important role in education, internal reporting, and specific analytical contexts. Whether used for foundational learning or practical applications, the account form balance sheet is a testament to the enduring relevance of basic accounting principles in modern financial management.