Definition: An account balance is the difference between the debits and credits posted to the account during the current accounting period plus the beginning balance. Not all accounts maintain balances from one accounting period to the next. Temporary accounts are closed at the end of each accounting cycle to permanent accounts, which carry the balances on to the next accounting period.

All accounts have either a debit or credit balance. Keep in mind that this does not mean a positive or negative balance. Instead, a debit refers to entries in a t-account on the left side while a credit is an entry on the right side.

What Does Account Balance Mean?

Contents

- What Does Account Balance Mean?

- Example

- The Dual Nature of Account Balances

- Contra Accounts and Their Role

- Account Balances and Financial Statements

- Temporary vs. Permanent Account Balances

- Reconciliation and Accuracy of Account Balances

- Technology and Modern Account Balances

- Real-World Application: Managing Cash Flow

- The Importance of Account Balances in Decision-Making

- Frequently Asked Questions

- Bottom Line

An account balance is a fundamental concept in accounting, representing the net amount in an account after summing debits, credits, and any beginning balance. It provides insight into a company’s financial position and is critical for accurate reporting, reconciliation, and decision-making.

An account balance is a fundamental concept in accounting, representing the net amount in an account after summing debits, credits, and any beginning balance. It provides insight into a company’s financial position and is critical for accurate reporting, reconciliation, and decision-making.

While the concept may appear simple, its application across various account types and scenarios reveals its significance in maintaining financial accuracy.

Asset accounts have debit balances while liability and equity accounts have credit balances. There are a few exceptions to this rule, however. Contra accounts have a balance opposite from their classification. In other words, a contra asset account actually has a credit balance and a contra equity account has a debit balance. These contra accounts reduce their associated category level.

Account balances are calculated by starting with the beginning balance. The debits are totaled, the credits are totaled, and all three are combined together. This is the ending account balance.

Example

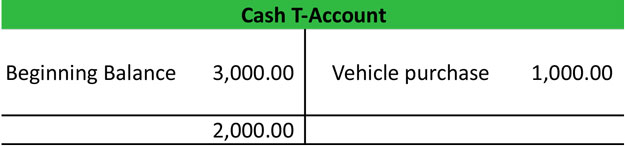

It’s easiest to see the calculation with a t-account. Let’s look at the cash t-account for example. This account has a beginning debit balance of $3,000. During the accounting period, the company used $1,000 to purchase a vehicle. The $1,000 purchase is recorded as a credit and reduces the overall cash balance.

The ending balance in the cash account equals a debit of $2,000 (the beginning $3,000 minus the $1,000 credit). As you can see, the difference between the debits and credits including the beginning balance equals the account balance.

Temporary accounts like income and expenses accounts don’t have beginning balances, so their ending balance is just the difference between the debits and credits of the current period.

The Dual Nature of Account Balances

Account balances are rooted in the double-entry accounting system, where every transaction affects at least two accounts. This system ensures that the accounting equation—Assets = Liabilities + Equity—remains balanced. Each account has a natural balance type:

- Asset Accounts: Typically carry a debit balance, indicating resources owned by the business. Examples include Cash, Accounts Receivable, and Inventory.

- Liability and Equity Accounts: Usually carry a credit balance, reflecting obligations or ownership claims. Examples include Accounts Payable, Loans Payable, and Retained Earnings.

The distinction between debit and credit balances is crucial for understanding financial statements. For instance, a positive balance in a liability account (a credit) indicates an obligation, while a positive balance in an asset account (a debit) represents a resource.

Contra Accounts and Their Role

Contra accounts add complexity by maintaining balances opposite to their classification. For example, a contra asset account like Accumulated Depreciation carries a credit balance, reducing the total assets reported. Similarly, a contra revenue account, such as Sales Returns and Allowances, has a debit balance that offsets revenue.

These accounts play an essential role in providing a more accurate picture of financial performance and position. For example, reporting gross revenue without considering contra accounts like Sales Returns could mislead stakeholders about the company’s actual earnings.

Account Balances and Financial Statements

The balances of accounts directly feed into the preparation of financial statements:

Balance Sheet: The balances of asset, liability, and equity accounts determine the company’s financial position at a specific point in time.

Income Statement: The balances of revenue and expense accounts reflect the company’s performance over a period, culminating in net income or loss.

For example, the cash balance derived from the Cash account on the balance sheet provides a snapshot of liquidity, while the balances in revenue and expense accounts help calculate profitability.

Temporary vs. Permanent Account Balances

One of the critical distinctions in accounting is between temporary and permanent accounts:

Temporary Accounts: These include revenue, expense, and dividend accounts, which are reset to zero at the end of each accounting period. Their balances are transferred to permanent accounts, typically Retained Earnings, through the closing process.

Permanent Accounts: These include asset, liability, and equity accounts, which carry their balances forward across periods.

For instance, if a company earns $50,000 in revenue during a period, that balance is closed to Retained Earnings at the end of the period. Meanwhile, the balance in the Cash account reflects ongoing transactions and remains intact.

Reconciliation and Accuracy of Account Balances

Reconciliation is a key process in maintaining accurate account balances. By comparing the balances in accounts, such as Cash, with external records like bank statements, businesses can identify discrepancies and ensure completeness.

For example, if a company’s Cash account shows a balance of $10,000 but the bank statement indicates $9,800, reconciliation can uncover the difference—perhaps due to unrecorded bank fees or outstanding checks. This process is critical for detecting errors, preventing fraud, and maintaining trust in financial records.

Technology and Modern Account Balances

Modern accounting systems, such as QuickBooks and SAP, automate the calculation and tracking of account balances. These systems update balances in real time, ensuring that financial records are always current and accurate.

For instance, when a sale is recorded, the system automatically debits Accounts Receivable and credits Revenue, updating both balances instantly. Such automation reduces the risk of human error and streamlines the accounting process, allowing businesses to focus on analysis rather than manual calculations.

Real-World Application: Managing Cash Flow

Account balances play a pivotal role in cash flow management. By monitoring balances in accounts like Cash, Accounts Receivable, and Accounts Payable, businesses can forecast future cash inflows and outflows, ensuring sufficient liquidity to meet obligations.

For example, if a company’s Cash account shows a low balance but Accounts Receivable has a high balance, management may prioritize collections to improve liquidity. Conversely, a high Accounts Payable balance may prompt discussions with suppliers to negotiate extended payment terms.

The Importance of Account Balances in Decision-Making

Account balances are essential for informed decision-making. They provide the data needed for ratio analysis, budgeting, and financial forecasting. For instance, comparing the balances of Current Assets and Current Liabilities helps calculate the current ratio, a key indicator of liquidity.

Similarly, analyzing trends in account balances, such as a steady increase in Accounts Receivable, can signal potential issues with collections or customer credit policies. This information empowers businesses to take proactive measures, improving financial stability.

Frequently Asked Questions

What is an account balance in accounting?

An account balance is the net amount in an account after summing all debits, credits, and the beginning balance. It represents the current value or obligation associated with the account.

How is an account balance calculated?

An account balance is calculated by starting with the beginning balance, adding total debits, subtracting total credits, and combining these amounts. This calculation reflects the ending balance at a specific point in time.

What is the difference between debit and credit balances?

A debit balance means the debits exceed credits, common in asset and expense accounts, while a credit balance means credits exceed debits, typical for liability, equity, and revenue accounts. These balances indicate the nature and classification of the account.

Why are account balances important in financial statements?

Account balances are essential for preparing accurate financial statements, as they summarize the financial position and performance of a business. They directly contribute to reports like the balance sheet and income statement.

Bottom Line

Account balances are more than just numbers on a ledger; they are the foundation of accurate financial reporting and effective decision-making. By tracking the net amounts in each account, businesses can assess their financial health, ensure compliance, and plan for the future.

Understanding the interplay between debit and credit balances, the role of contra accounts, and the distinction between temporary and permanent accounts provides a comprehensive view of how account balances function within an accounting system. As technology continues to evolve, the ability to manage and analyze account balances will remain a cornerstone of sound financial management.