What is a General Journal?

Contents [show]

The general journal, also called the book of first entry, is a record of business transactions and events for a specific account. In other words, this journal chronologically stores all the journal entries for a specific account or group of account in one place, so management and bookkeepers can analyze the data.

Accounting journals are often called the book of first entry because this is where journal entries are made. Once a business transaction is made, the bookkeeper records that event in the form of a journal entry in one of the accounting journals. Then, at the end of a period, the journals are posted to accounting ledgers for reporting purposes.

Companies use many different journals depending on their accounting system and industry, but all companies use the general journal.

General Journal Contents

The general journal is an accounting journal used to record journal entries for all types of transactions. Many companies use this journal exclusively to record all of their journal entries in the entire accounting system. There are pros and cons to this approach as it tends to make the journal extremely large and is difficult to search. Even the smallest businesses’ GL would be 200-500 pages.

Having something this large typically isn’t practical, so most companies use the GL only to record general items like depreciation. Transactions that can fit into a more specific categories can be recorded in special accounting journals. We’ll talk more about these in a bit.

You can think of it like this. The General Journal is a catch-all journal where transactions that don’t fit into special categories are recorded. All modern GLs are computerized with accounting software like Quickbooks, so GL maintenance is pretty simple. Now that we know what is in the GL, let’s take a look at how it is formatted.

Format and Template

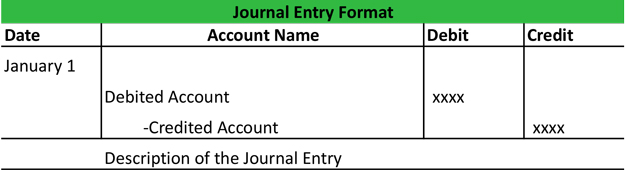

Most journals are formatted the same way with columns for the transaction dates, account names, debit and credit amounts, as well as a brief description of the transaction. Does this sound familiar? It should. This is a typical journal entry format. That’s all a journal is. It’s just a list of journal entries recorded in one place.

Here’s a general journal template example.

Example

How to Use the General Journal

Throughout the accounting period, a business enters into transactions with customers, vendors, suppliers, the government, and other entities. All of these transactions must be recorded in order to accurately show the financial standings of the company at the end of the period.

In order to do this, a bookkeeper makes journal entries in the general journal recording changes in the corresponding accounts for a given transaction. For example, if a business purchased a new company vehicle for cash, the bookkeeper would record a journal entry that debits the vehicle account and credits the cash account.

At the end of the period, all of the entries in the general journal are tallied up in their corresponding accounts and are reported on the trial balance.

Special Journals

Accounting Journals

In addition to the general journal, there are several special journals or subsidiary journals that are used to help divide and organize business transactions.

Here’s a list of the special accounting journals used:

- Cash Receipts Journal

- Cash Disbursements Journal

- Purchases Journal

- Sales Journal

- Purchase Return Journal

- Sales Return Journal

- General Journal

Each of these journals has a special purpose and are used to record specific types of transactions. For example, the cash receipts journal contains all of the cash sale transactions. The accounts receivable or credit sales journal contains all the transactions for credit sales.

Other journals like the sales journal and cash disbursements journal are also used the help management organize and analyze accounting information.

Now that you understand the GL and how it’s used, let’s look at how to create a trial balance.