Accounts receivable turnover is an efficiency ratio or activity ratio that measures how many times a business can turn its accounts receivable into cash during a period. In other words, the accounts receivable turnover ratio measures how many times a business can collect its average accounts receivable during the year.

A turn refers to each time a company collects its average receivables. If a company had $20,000 of average receivables during the year and collected $40,000 of receivables during the year, the company would have turned its accounts receivable twice because it collected twice the amount of average receivables.

This ratio shows how efficient a company is at collecting its credit sales from customers. Some companies collect their receivables from customers in 90 days while other take up to 6 months to collect from customers.

In some ways the receivables turnover ratio can be viewed as a liquidity ratio as well. Companies are more liquid the faster they can covert their receivables into cash.

Formula

Contents [show]

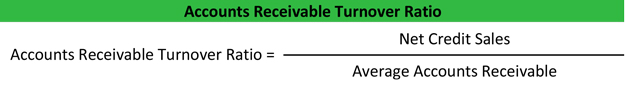

Accounts receivable turnover is calculated by dividing net credit sales by the average accounts receivable for that period.

The reason net credit sales are used instead of net sales is that cash sales don’t create receivables. Only credit sales establish a receivable, so the cash sales are left out of the calculation. Net sales simply refers to sales minus returns and refunded sales.

The net credit sales can usually be found on the company’s income statement for the year although not all companies report cash and credit sales separately. Average receivables is calculated by adding the beginning and ending receivables for the year and dividing by two. In a sense, this is a rough calculation of the average receivables for the year.

Analysis

Since the receivables turnover ratio measures a business’ ability to efficiently collect its receivables, it only makes sense that a higher ratio would be more favorable. Higher ratios mean that companies are collecting their receivables more frequently throughout the year. For instance, a ratio of 2 means that the company collected its average receivables twice during the year. In other words, this company is collecting is money from customers every six months.

Higher efficiency is favorable from a cash flow standpoint as well. If a company can collect cash from customers sooner, it will be able to use that cash to pay bills and other obligations sooner.

Accounts receivable turnover also is and indication of the quality of credit sales and receivables. A company with a higher ratio shows that credit sales are more likely to be collected than a company with a lower ratio. Since accounts receivable are often posted as collateral for loans, quality of receivables is important.

Example

Bill’s Ski Shop is a retail store that sells outdoor skiing equipment. Bill offers accounts to all of his main customers. At the end of the year, Bill’s balance sheet shows $20,000 in accounts receivable, $75,000 of gross credit sales, and $25,000 of returns. Last year’s balance sheet showed $10,000 of accounts receivable.

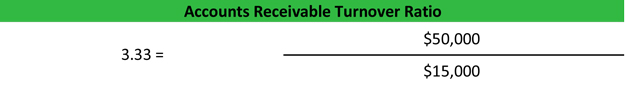

The first thing we need to do in order to calculate Bill’s turnover is to calculate net credit sales and average accounts receivable. Net credit sales equals gross credit sales minus returns (75,000 – 25,000 = 50,000). Average accounts receivable can be calculated by averaging beginning and ending accounts receivable balances ((10,000 + 20,000) / 2 = 15,000).

Finally, Bill’s accounts receivable turnover ratio for the year can be like this.

As you can see, Bill’s turnover is 3.33. This means that Bill collects his receivables about 3.3 times a year or once every 110 days. In other words, when Bill makes a credit sale, it will take him 110 days to collect the cash from that sale.