Gross profit margin is a profitability ratio that calculates the percentage of sales that exceed the cost of goods sold. In other words, it measures how efficiently a company uses its materials and labor to produce and sell products profitably. You can think of it as the amount of money from product sales left over after all of the direct costs associated with manufacturing the product have been paid. These direct costs are typically called cost of goods sold or COGS and usually consist of raw materials and direct labor.

The gross profit ratio is important because it shows management and investors how profitable the core business activities are without taking into consideration the indirect costs. In other words, it shows how efficiently a company can produce and sell its products. This gives investors a key insight into how healthy the company actually is. For instance, a company with a seemingly healthy net income on the bottom line could actually be dying. The gross profit percentage could be negative, and the net income could be coming from other one-time operations. The company could be losing money on every product they produce, but staying a float because of a one-time insurance payout.

That is why it is almost always listed on front page of the income statement in one form or another. Let’s take a look at how to calculate gross profit and what it’s used for.

Formula

Contents [show]

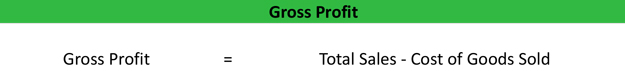

The gross profit formula is calculated by subtracting total cost of goods sold from total sales.

Both the total sales and cost of goods sold are found on the income statement. Occasionally, COGS is broken down into smaller categories of costs like materials and labor. This equation looks at the pure dollar amount of GP for the company, but many times it’s helpful to calculate the gross profit rate or margin as a percentage.

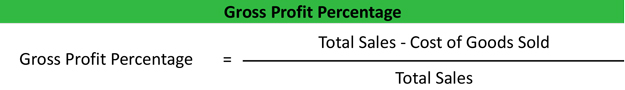

The gross profit percentage formula is calculated by subtracting cost of goods sold from total revenues and dividing the difference by total revenues. Usually a gross profit calculator would rephrase this equation and simply divide the total GP dollar amount we used above by the total revenues. Both equations get the result.

Example

Monica owns a clothing business that designs and manufactures high-end clothing for children. She has several different lines of clothing and has proven to be one of the most successful brands in her space. Here’s what appears on Monica’s income statement at the end of the year.

- Total sales: $1,000,000

- COGS: $350,000

- Rent: $100,000

- Utilities: $10,000

- Office expenses: $2,500

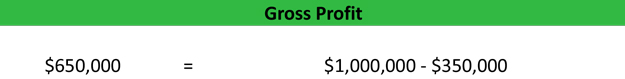

Monica has an upcoming meeting with investors and wants to know how to find gross profit and what method to use. First, we can calculate Monica’s overall dollar amount of GP by subtracting the $350,000 of COGS from the $1,000,000 of total sales like this:

As you can see, Monica has a GP of $650,000. This means the goods that she sold for $1M only cost her $350,000 to produce. Now she has $650,000 that can be used to pay for other bills like rent and utilities.

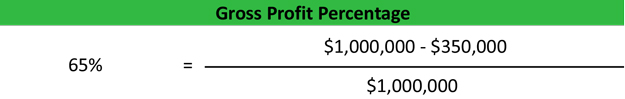

Monica can also compute this ratio in a percentage using the gross profit margin formula. Simply divide the $650,000 GP that we already computed by the $1,000,000 of total sales.

Monica is currently achieving a 65 percent GP on her clothes. This means that for every dollar of sales Monica generates, she earns 65 cents in profits before other business expenses are paid.

Analysis

The gross profit method is an important concept because it shows management and investors how efficiently the business can produce and sell products. In other words, it shows how profitable a product is.

The concept of GP is particularly important to cost accountants and management because it allows them to create budgets and forecast future activities. For instance, Monica’s GP was $650,000. This means if she wants to be profitable for the year, all of her other costs must be less than $650,000. Conversely, Monica can also view the $650,000 as the amount of money that can be put toward other business expenses or expansion into new markets.

Investors are typically interested in GP as a percentage because this allows them to compare margins between companies no matter their size or sales volume. For instance, an investor can see Monica’s 65 percent margin and compare it to Ralph Lauren’s margin even though RL is a billion dollar company. It also allows investors a chance to see how profitable the company’s core business activities are.

General Motors is a good example of this back in the 1990s. GM had a low margin and wasn’t making much money one each car they were producing, but GM was profitable. Why? Because GM’s financing services were raking in the money. In other words, GM was making more money financing cars like a bank than they were producing cars like a manufacturer. Investors want to know how healthy the core business activities are to gauge the quality of the company.

They also use a gross profit margin calculator to measure scalability. Monica’s investors can run different models with her margins to see how profitable the company would be at different sales levels. For instance, they could measure the profits if 100,000 units were sold or 500,000 units were sold by multiplying the potential number of units sold by the sales price and the GP margin.