Return on capital employed or ROCE is a profitability ratio that measures how efficiently a company can generate profits from its capital employed by comparing net operating profit to capital employed. In other words, return on capital employed shows investors how many dollars in profits each dollar of capital employed generates.

ROCE is a long-term profitability ratio because it shows how effectively assets are performing while taking into consideration long-term financing. This is why ROCE is a more useful ratio than return on equity to evaluate the longevity of a company.

This ratio is based on two important calculations: operating profit and capital employed. Net operating profit is often called EBIT or earnings before interest and taxes. EBIT is often reported on the income statement because it shows the company profits generated from operations. EBIT can be calculated by adding interest and taxes back into net income if need be.

Capital employed is a fairly convoluted term because it can be used to refer to many different financial ratios. Most often capital employed refers to the total assets of a company less all current liabilities. This could also be looked at as stockholders’ equity less long-term liabilities. Both equal the same figure.

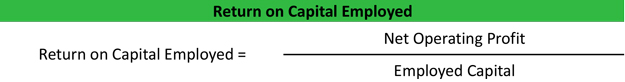

Formula

Contents [show]

Return on capital employed formula is calculated by dividing net operating profit or EBIT by the employed capital.

If employed capital is not given in a problem or in the financial statement notes, you can calculate it by subtracting current liabilities from total assets. In this case the ROCE formula would look like this:

It isn’t uncommon for investors to use averages instead of year-end figures for this ratio, but it isn’t necessary.

Analysis

The return on capital employed ratio shows how much profit each dollar of employed capital generates. Obviously, a higher ratio would be more favorable because it means that more dollars of profits are generated by each dollar of capital employed.

For instance, a return of .2 indicates that for every dollar invested in capital employed, the company made 20 cents of profits.

Investors are interested in the ratio to see how efficiently a company uses its capital employed as well as its long-term financing strategies. Companies’ returns should always be high than the rate at which they are borrowing to fund the assets. If companies borrow at 10 percent and can only achieve a return of 5 percent, they are loosing money.

Just like the return on assets ratio, a company’s amount of assets can either hinder or help them achieve a high return. In other words, a company that has a small dollar amount of assets but a large amount of profits will have a higher return than a company with twice as many assets and the same profits.

Example

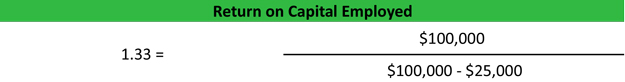

Scott’s Auto Body Shop customizes cars for celebrities and movie sets. During the year, Scott had a net operating profit of $100,000. Scott reported $100,000 of total assets and $25,000 of current liabilities on his balance sheet for the year.

Accordingly, Scott’s return on capital employed would be calculated like this:

As you can see, Scott has a return of 1.33. In other words, every dollar invested in employed capital, Scott earns $1.33. Scott’s return might be so high because he maintains low assets level.

Companies with large cash reserves usually skew this ratio because cash is included in the employed capital computation even though it isn’t technically employed yet.