The return on equity ratio or ROE is a profitability ratio that measures the ability of a firm to generate profits from its shareholders investments in the company. In other words, the return on equity ratio shows how much profit each dollar of common stockholders’ equity generates.

So a return on 1 means that every dollar of common stockholders’ equity generates 1 dollar of net income. This is an important measurement for potential investors because they want to see how efficiently a company will use their money to generate net income.

ROE is also and indicator of how effective management is at using equity financing to fund operations and grow the company.

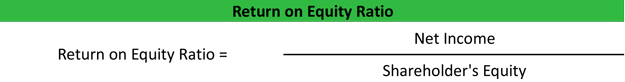

Formula

Contents [show]

The return on equity ratio formula is calculated by dividing net income by shareholder’s equity.

Most of the time, ROE is computed for common shareholders. In this case, preferred dividends are not included in the calculation because these profits are not available to common stockholders. Preferred dividends are then taken out of net income for the calculation.

Also, average common stockholder’s equity is usually used, so an average of beginning and ending equity is calculated.

Analysis

Return on equity measures how efficiently a firm can use the money from shareholders to generate profits and grow the company. Unlike other return on investment ratios, ROE is a profitability ratio from the investor’s point of view—not the company. In other words, this ratio calculates how much money is made based on the investors’ investment in the company, not the company’s investment in assets or something else.

That being said, investors want to see a high return on equity ratio because this indicates that the company is using its investors’ funds effectively. Higher ratios are almost always better than lower ratios, but have to be compared to other companies’ ratios in the industry. Since every industry has different levels of investors and income, ROE can’t be used to compare companies outside of their industries very effectively.

Many investors also choose to calculate the return on equity at the beginning of a period and the end of a period to see the change in return. This helps track a company’s progress and ability to maintain a positive earnings trend.

Example

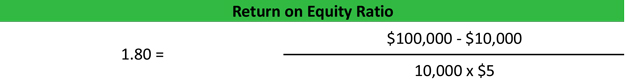

Tammy’s Tool Company is a retail store that sells tools to construction companies across the country. Tammy reported net income of $100,000 and issued preferred dividends of $10,000 during the year. Tammy also had 10,000, $5 par common shares outstanding during the year. Tammy would calculate her return on common equity like this:

As you can see, after preferred dividends are removed from net income Tammy’s ROE is 1.8. This means that every dollar of common shareholder’s equity earned about $1.80 this year. In other words, shareholders saw a 180 percent return on their investment. Tammy’s ratio is most likely considered high for her industry. This could indicate that Tammy’s is a growing company.

An average of 5 to 10 years of ROE ratios will give investors a better picture of the growth of this company.

Company growth or a higher ROE doesn’t necessarily get passed onto the investors however. If the company retains these profits, the common shareholders will only realize this gain by having an appreciated stock.