Return on Retained Earnings (RORE) is a financial ratio that calculates how much a company earns for its shareholders by reinvesting its profits back into the company. The ratio is expressed as a percentage, with a larger number meaning, of course, a higher return.

Definition – What is the Return on Retained Earnings Ratio?

Contents [show]

The return on retained earnings ratio is an important tool for investors, as it reveals a lot about the company’s efficiency and growth potential. Low return on retained earnings signals to investors the company should be distributing profits as dividends to shareholders, since those dollars aren’t producing much additional growth for the company. In other words, the dollars can be of more benefit attracting new investors and keeping current shareholders happy via a dividend payment.

So, to start the evaluation process, locate the company’s annual report or look at historical earnings press releases and follow the steps below to see how to calculate the ROCE ratio.

Formula

There are a few different ways to arrive at the return on retained earnings. The simplest way to calculate the return on retained earnings formula is by using published information on earnings per share (EPS) over a period of your choosing, say five years.

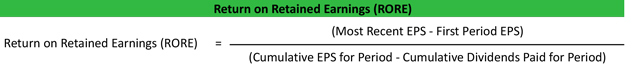

The RORE equation would look like this:

Return on Retained Earnings % = (Most Recent EPS – First Period EPS) / (Cumulative EPS for Period – Cumulative Dividends Paid for Period)

To calculate, first find the sum of all earnings per share over the period you are evaluating and the sum of all dividends paid to shareholders during this time. Subtract the cumulative dividends paid from the cumulative EPS. This is your denominator for the next step.

Step two is to find the difference, or growth/loss over time, in EPS from the beginning to end of the period. Divide this answer by the answer in step one. This value is expressed as a percentage.

Example

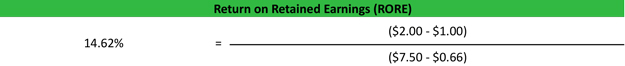

ABC, Inc. has paid a 1% dividend to common shareholders over the past five years and has steadily increasing earnings per share (EPS). Sally wants to evaluate ABC’s growth potential by looking at return on retained earnings. She adds up the previous five years of EPS ($1.00)

$1.30; $1.50; $1.70; and $2.00). Then, she adds up the annual dividend paid in those years ($0.01; $0.13; $0.15; $0.17; and $0.20). Sally uses the following formula to find ABC, Inc.’s return on retained earnings over the past five years.

RORE = ($2.00 – $1.00) / ($7.50 – $0.66) = $1.00 / $6.84 = 14.62%

Sally sees that the return on retained earnings is just under 15%. She compares that with other companies in the sector and sees that ABC, Inc. is generating a decent RORE and likes the continued growth prospects of the company.

Analysis and Interpretation

Now let’s look deeper into why Sally thought a nearly-15% return on retained earnings was good. When looking for a stock with steady growth, the goal is to find one that is generating more earnings year after year with the money they’ve held back from shareholders.

A shareholder can be satisfied by a small 1% dividend like ABC, Inc. has historically paid, as long as there are still gains on the shares. In a market where a bondholder may only yield a 5% return, the 1% dividend coupled with the 15% return on retained earnings that produced a 50% increase in EPS over five years is more attractive.

The important takeaway is that the RORE is relative to the nature of the business and its competitors. If another company in the same sector is producing a lower return on retained earnings, it doesn’t necessarily mean it’s a bad investment. It may just mean the company is older and no longer in a high growth stage. At such a stage in the business cycle, it would be expected to see a lower RORE and higher dividend payout.

Usage Explanations and Cautions

The usefulness of the return on retained earnings calculation is apparent for investors, as it can help distinguish growth opportunities and even reveal if a company is more stable and just kicking off high dividends to shareholders from its earnings. It is also important to the executive team to monitor the efficiency of the business. Lower returns on retained earnings could signal a need for process improvements or something else to generate more profit from the capital.

It is also helpful to use this knowledge to see how well the company’s retained earnings have contributed to any increase in the stock’s market price over time. Companies with a high RORE but an incongruent increase in market price may have other factors that need to be evaluated. So, it’s important to use the return on retained earnings as a complement to other financial analysis tools.