The times interest earned ratio, sometimes called the interest coverage ratio, is a coverage ratio that measures the proportionate amount of income that can be used to cover interest expenses in the future.

In some respects the times interest ratio is considered a solvency ratio because it measures a firm’s ability to make interest and debt service payments. Since these interest payments are usually made on a long-term basis, they are often treated as an ongoing, fixed expense. As with most fixed expenses, if the company can’t make the payments, it could go bankrupt and cease to exist. Thus, this ratio could be considered a solvency ratio.

Formula

Contents [show]

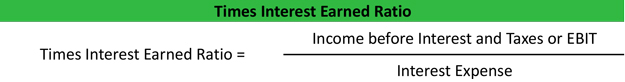

The times interest earned ratio is calculated by dividing income before interest and income taxes by the interest expense.

Both of these figures can be found on the income statement. Interest expense and income taxes are often reported separately from the normal operating expenses for solvency analysis purposes. This also makes it easier to find the earnings before interest and taxes or EBIT.

Analysis

The times interest ratio is stated in numbers as opposed to a percentage. The ratio indicates how many times a company could pay the interest with its before tax income, so obviously the larger ratios are considered more favorable than smaller ratios.

In other words, a ratio of 4 means that a company makes enough income to pay for its total interest expense 4 times over. Said another way, this company’s income is 4 times higher than its interest expense for the year.

As you can see, creditors would favor a company with a much higher times interest ratio because it shows the company can afford to pay its interest payments when they come due. Higher ratios are less risky while lower ratios indicate credit risk.

Example

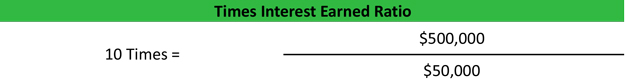

Tim’s Tile Service is a construction company that is currently applying for a new loan to buy equipment. The bank asks Tim for his financial statements before they will consider his loan. Tim’s income statement shows that he made $500,000 of income before interest expense and income taxes. Tim’s overall interest expense for the year was only $50,000. Tim’s time interest earned ratio would be calculated like this:

As you can see, Tim has a ratio of ten. This means that Tim’s income is 10 times greater than his annual interest expense. In other words, Tim can afford to pay additional interest expenses. In this respect, Tim’s business is less risky and the bank shouldn’t have a problem accepting his loan.