A simple multiple step income statement separates income, expenses, gains, and losses into two meaningful sub-categories called operating and non-operating. Unlike the single step income statement format where all revenues are combined in one main income listing and all expenses are totaled together, the multiple step statement lists these activities in separate sections, so users can better understand of the core business operations.

This is particularly helpful for analyzing the performance of the business. Investors and creditors can evaluate how well a company performs its main functions separate from any other activities the business is involved in. For instance, a retailer’s main function is to sell merchandise. Investors and creditors want to know how efficiently the retailer sells its merchandise without diluting the numbers with other gains and losses from non-merchandise related sales.

To do this, all income and expenses cannot be listed together. They must be separated into meaningful categories.

Format

Contents [show]

The multistep income statement format is broken down into two main sections: operating and non-operating.

Operating Section

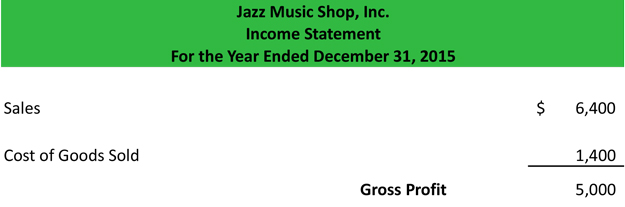

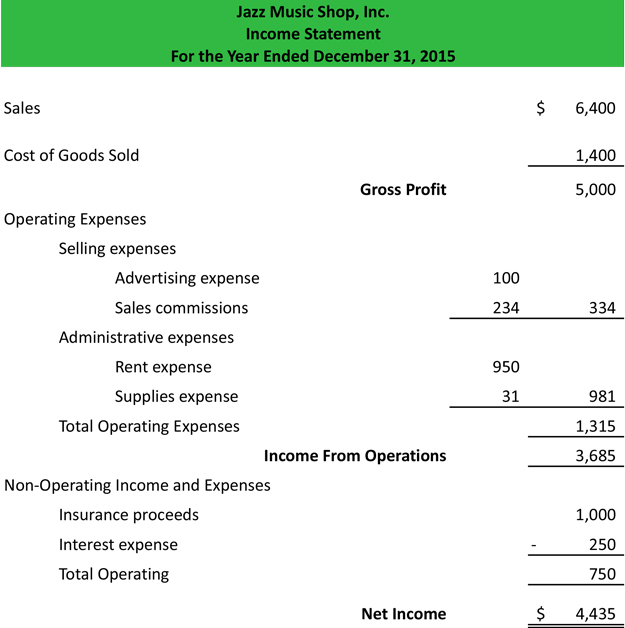

The operating section is subdivided into two main sections that list the primary business income and expenses. The first section computes the gross profit of the business by subtracting the cost of goods sold from the total sales. This is a key figure for investors, creditors, and internal management because it shows how profitable the company is at selling its goods or making its products.

Going back to our retailer example, the total sales figure would include all merchandise sales made during the period and the cost of goods sold would include all expenses paid to purchase, ship, and get the merchandise ready for sale. The gross margin computes the amount of money the company profits from the sales of its merchandise. Keep in mind, no other expenses are taken into account yet. This is simply the cash flow in from the sales of merchandise and the cash flow out from the purchase of that merchandise. This section not only helps measure the profitability of the core business activities, it also helps measure the health of the business.

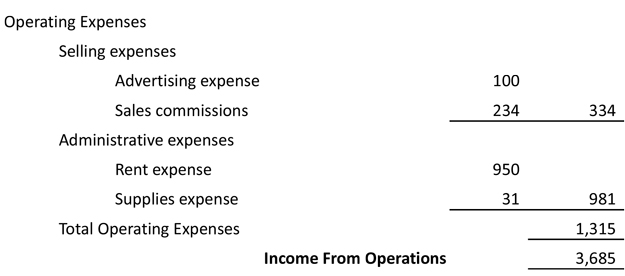

The second part of the operating section lists all of the operating expenses in two separate categories: selling and administrative. Selling expenses are exactly what they sound like: costs incurred to sell products. These expenditures typically include advertising, salesmen salaries, commissions, and freight. The administrative expenses include expenditures that aren’t directly related to selling product like rent, office staff salaries, and supplies.

The selling and administrative expense sections are added together to compute the total operating expenses. This total expense line is subtracted from the gross profit computed in the first section to arrive at the company’s operating income.

Non-Operating and Other

The non-operating and other section lists all business revenues and expenses that don’t relate to the business’ principle activities. For example, our retailer isn’t in the business of receiving insurance proceeds. If a tree hit the building and the insurance company paid out a small settlement, the income would not be reported with total sales. It would be reported in the non-operating and other section because it doesn’t have anything to do with sales.

Other income and expenses like interest, lawsuit settlements, extraordinary items, and gains or losses from investments are also listed in this section. Unlike the operating section, the non-operating section is not split into subcategories. It simply lists all of the activities and totals them at the bottom.

Once the non-operating section is totaled, it is subtracted from or added to the income from operations to compute the net income for the period.

Example

Let’s take a look at a multi step income statement example.

As you can see, this multi step income statement template computes net income in three steps.

Step 1: Compute Gross Profit (Total sales – Cost of goods sold)

Step 2: Compute Income From Operations (Gross profit – operating expenses)

Step 3: Compute Net Income (Income from operations – non-operating and other)

The cost of goods sold is separated from the operating expenses and listed in the gross margin section. This is particularly important because it gives investors, creditors, and management the ability to analyze the financial statement sales and purchasing efficiency.

The operating section clearly lists the operating income of the company. This is the amount of money the company made from selling its products after all operating expenses have been paid. This is a key figure because it shows the health of the business. If a company’s operations are strong, it will almost always show a profit at the bottom line, but not all companies with a profitable bottom line have strong operations. Take our retailer for example. It might have lost money from its operations but had a huge insurance settlement that pushed a profit to the bottom line. Is this business healthy? Probably not. That’s why this section is so important.

Lastly, you can see the non-operating and other section being subtracted to compute the net income.

The multistep income statement gives far more detail than the single step statement, but it can also be more misleading if not prepared correctly. For instance, management might shift expenses out of cost of goods sold and into operations to artificially improve their margins. It’s always important to view comparative financial statements over time, so you can see trends and possibly catch misleading placement of expenses.