What is the Expanded Accounting Equation?

Contents

The expanded accounting equation takes the basic accounting equation and splits equity into its four main elements: owner’s capital, owner’s withdrawals, revenues, and expenses. Both the assets and liabilities section of the basic equation remains the same in the expanded equation.

Expanding the equity section shows how equity created from two main sources: investors’ contributions and company profits. Conversely, equity it decreased by investors leaving the company and company losses.

The expanded accounting equation also demonstrates the relationship between the balance sheet and the income statement by seeing how revenues and expenses flow through into the equity of the company.

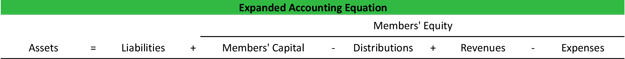

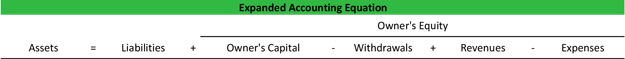

Since corporations, partnerships, and sole proprietorships are different types of entities, they have different types of owners. For instance, corporations have stockholders and paid-in capital accounts; where as, partnerships have owner’s contribution and distribution accounts. Thus, all of these entities have a slightly different expanded equation.

Different Types of the Expanded Accounting Equation

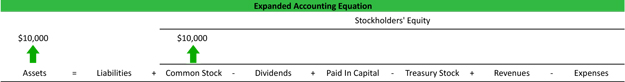

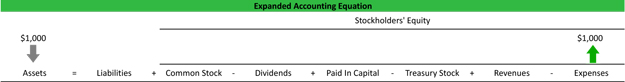

Here is the expanded accounting equation for a corporation.

![]()

Here is the expanded accounting equation for a partnership.

Here is the expanded accounting equation for a sole proprietorship.

Notice that all of the equations’ assets and liabilities remain the same—only the ownership accounts are changed.

Examples

How to use the Expanded Accounting Equation

Let’s take a look at a few example business transactions for a corporation to see how they affect its expanded equation.

— At the beginning of the year, Corporation X was formed and 1,000, $10 par value stocks were issued. X receives the cash from the new shareholders and also grants them equity in the company. Thus, assets increase and common stock increases.

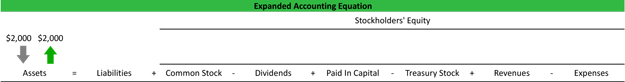

— X uses $2,000 of its cash to purchase a new equipment. This transaction decreases assets when the cash is distributed and increases assets when the new equipment is received.

— X hires an employee to start producing products with its new equipment. After two weeks, X cuts a payroll check to its employee. The cash disbursement reduces assets and the payroll expense is recorded as a reduction of equity.

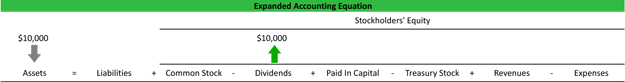

— At the end of the year, X ends up with large profits and the management decides to issue dividends to its shareholders. X issues a $10,000 dividend to its shareholders. When dividends are issued, cash is disbursed to shareholders reducing assets while the dividends reduce equity.

As you can see from all of these examples, the expanded equation always balances just like the basic equation.