Definition: Withdrawals or owner withdrawals are payments from an owner’s share in a company. In other words, its money the owner took out of the company to use for personal expenses. Partnerships and sole proprietorships traditionally these transactions withdrawals whereas S corporations usually refer to them as distributions.

What Does Withdrawal Mean?

When an owner withdraws money from a company for personal use, the company takes this out of his share of capital. This makes sense because the owner is essentially cashing out his share in the company. He is receiving cash in exchange the company is buying back some of his capital.

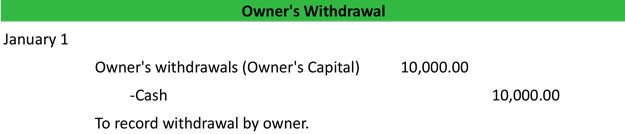

The company would record a journal entry for an owner withdrawal by debiting owner’s withdrawal and crediting cash. Owner’s withdrawal is a temporary capital or equity account that is closed to the general owner’s capital account at the end of the year.

Example

Let’s assume Mike has a 50% share of Blue Guitar, LLC. He decides that he wants to buy a new car, so he withdraws $10,000 from his share in the partnership. Blue Guitar, LLC would record a debit the Mike’s capital withdrawals account and a credit to cash for $10,000.

After the closing of the year, Mike’s capital account will be $10,000 less because of this withdrawal.