Definition: The marginal propensity to save (MPS) is the percentage of additional income that consumers place into savings instead of spending on goods and services. MPS is calculated as the product of a change in each successive level of saving to the change in each successive level of income.

What Does Marginal Propensity to Save Mean?

What is the definition of MPS? The propensity to save is the collective tendency of consumers to save money instead of spending it. In this context, the propensity to save is closely related to the propensity to consume. When consumers have a higher income, after a certain point of spending, they start saving. Each additional dollar that a household uses for saving is the MPS. In fact, MPS quantifies the relationship between income and saving, taking into consideration consumer behavior and consumer psychology. To calculate the MPS formula, we need to know the change in saving and the change in income.

Let’s look at an example.

Example

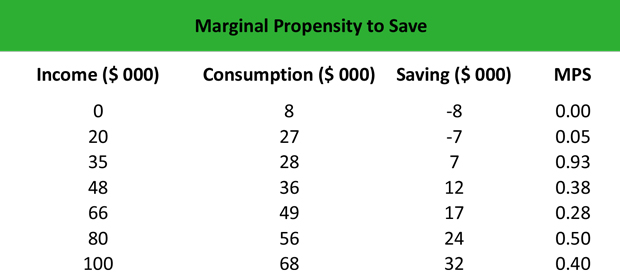

Lyn is an economist at a securities firm. She is responsible for collecting statistical data and performing a macroeconomic analysis. She is asked to calculate the marginal propensity to save for different household incomes. Marilyn constructs a table where the income ranges from 0 to $100,000. Based on the level of income, Lyn collects data for consumption and savings.

Lyn calculates the MPS by dividing the change in saving by the change in income. For an income of $0, consumers spend $8 and save nothing. For an income of $20,000, consumers spend $27,000 and save nothing. This generates an MPS of 0.05, which means that 5% of extra income goes for saving.

As the level of income increases, consumers spend less and start saving.

For an income $66,000, they spend $49,000 and save $17,000, generating an MPS of 0.28. Therefore, 28% of extra income goes for saving. This shows that consumer psychology forces consumers to save when they have a higher income.

Summary Definition

Define Marginal Propensity to Save: MPS is an economic equation that measures the ratio of money that consumers are willing and able to save at different levels of income.