Definition: Selling, General & Administrative Expense (SG&A) refer to the expenses that a company makes, directly or indirectly, for the promotion, advertising, marketing and administration of the company as well as the compensation of the workforce, among others.

What Does SG&A Mean?

Contents [show]

What is the definition of selling, general and administrative expenses? More specifically, the SG&A expense include all sorts of expenses that a company makes to support its operations and pay its employees.

Hence, SG & A include salaries, wages, and the associated taxes, utilities, marketing, advertising, promotion, sales, supplies, and insurance expenses, which are all reported on the income statement.

Let’s look at an example.

Example

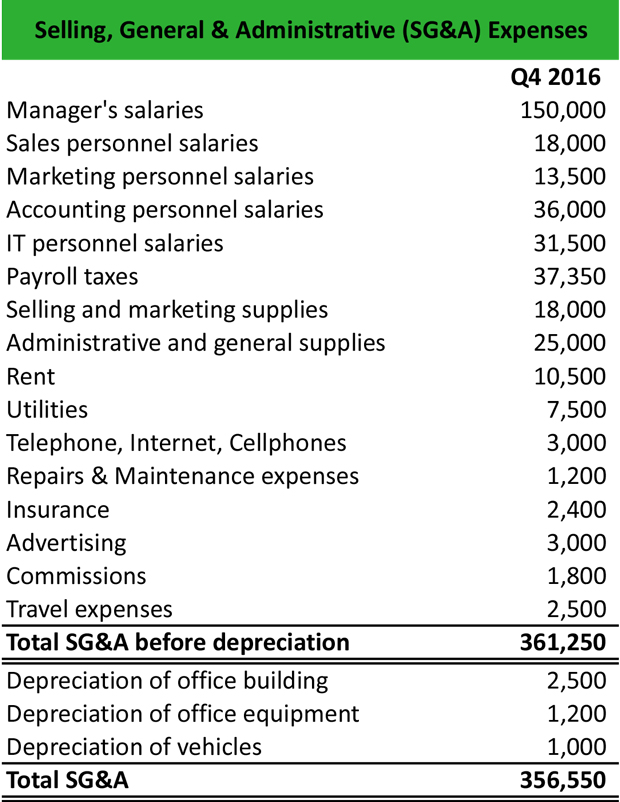

Anna Maria is an accountant in a retail company. She is asked to compile a list of the firm’s selling, General & administrative expenses, including the associated depreciation and present it to her manager before the closing of the quarterly results at the end of the week. Anna Maria compiles the following list:

Anna Maria includes the salaries of the personnel of all the company departments and the associated payroll taxes; rent, utilities, telephone, insurance, repairs & maintenance that pertain to the building and the office equipment; and finally, advertising expenses, commissions, travel expenses, selling and marketing supplies, and administrative and general supplies.

Once she calculates the SG & A before depreciation, she deducts the depreciation of the office building, the depreciation of the office equipment, and the depreciation of the vehicles. The net $356,550 is the amount that will be reported on the income statement.

Summary Definition

Define SGA Expenses: SG and A means all of the indirect and direct expenses associated with selling product including the administrative costs.