Definition: The Elliott Wave Theory is an investment tool used to analyze financial market cycles and estimate future market trends taking into account the investor behavior as well as price highs and lows.

What Does Elliot Wave Theory Mean?

What is the definition of the Elliot Wave Theory? The EWT, originally introduced by Ralph Nelson Elliott, provides stock market estimates considering a market’s unique features that can be identified in the wave patterns. By observing the impulse wave pattern, Elliott concluded that financial markets move in zigzags patterns forming waves.

Every five waves that move in the direction of the main trend, three corrective waves follow, forming the “5-3 move,” which is a complete cycle. Then, the 5-3 move splits into two parts that form the next 5-3 move and so on. The 5-3 move pattern is stable with a variation in the time span of each successive move.

Let’s look at an example.

Example

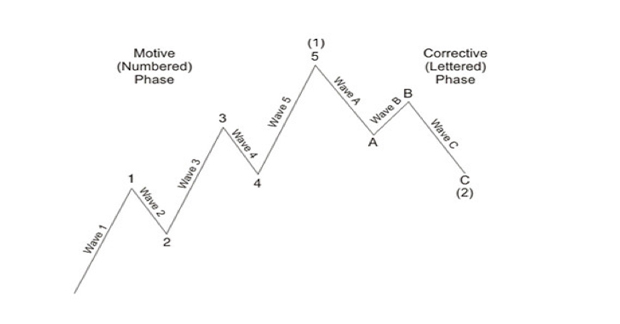

In fact, the EWT focuses on bullish trends for the five impulse wave moves and on bearish trends for the three-wave moves, which he views as corrections. In the following picture, we see a complete cycle of wave development from points 0 to 5, and then, from points A to C.

The five wave move starts from point 0 and completes at point 5, but the entire wave is broken down into five inner waves that connect point 0 to point 1; point 1 to point 2; point 2 to point 3; point 3 to point 4, and point 4 to point 5. Then, the corrective waves follow, starting from point 5 to point A, from point A to point B, and from point B to point C.

The EWT classifies waves based on their size. When traders identify a Supercycle, which is the main wave, they open a long position, and, as the wave enters the correction phase, they go short to close the position.

Summary Definition

Define The Elliot Wave Theory: The Elliot Wave Theory is a mathematical approach to explaining stock market trends and cycles with investors’ psychology.